Today we’d like to introduce you to Marcia Armstrong.

Hi Marcia, so excited to have you with us today. What can you tell us about your story?

I grew up in a household where money was deemed inaccessible. I watched my mom struggle to work and provide for four of us. Unfortunately, in this same vein, I also witnessed financial abuse at the hands of my father. Working for more money was used as a weapon. As a little girl, I made an inner vow that I won’t allow the same to happen to me.

I studied hard, worked hard, and provided for myself and was positioned to help my mom over the years which felt good. The turning point in my life happened in 2018 when I realized that I was existing in life and not living. I yearned for more but felt like I was in a paycheck-to-paycheck loop.

This felt more evident every time I gave money to those less fortunate and waited anxiously for my next paycheque. At that point, I had a conversation with God and asked him to provide more money so that when I gave, it would be from abundance and not lack. The short reply was, “You need to steward your money better”.

Because of that prayer, I became debt free one year later, started my business A Purpose Life, had a 12-month fully funded emergency fund, and savings in the bank.

I decided to use my personal breakthrough to help other millennial corporate professionals master their finances so that they develop a roadmap to wealth creation and financial independence.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

Losing your job is something that although you may see the writing on the wall, going through the experience is quite different. Because of this separation, I decided to bet on myself and go into full-time entrepreneurship instead of going back to corporate.

I had some seed money from my severance as well as savings but I had to learn how to switch from having an employee mindset to an entrepreneur mindset. In the beginning, I worked long hours to the point of exhaustion and didn’t see many results.

I knew nothing about Lead Generation, Marketing, Sales or Profit. It was a steep learning curve… most lessons I learned from trial and error. I also understood that there is a big difference between being busy and being productive.

I struggled to price my services because I still battled limiting beliefs about money and felt like an imposter although I had great results from my clients. I couldn’t see my worth and it showed in my prices.

A Purpose Life was created to give me time and financial freedom but instead, I felt like a slave to my business.

Entrepreneurship is not for the faint of heart. You have feast and famine moments but what has kept me is my ‘why’. This vision is bigger than me and because I continue to show up, others are taking notice.

Alright, so let’s switch gears a bit and talk business. What should we know?

A Purpose Life is a coaching and consulting firm based in Barbados but with a global reach as I’ve coached clients based in the USA. I am an award-winning Financial Coach who specializes in helping millennial corporate professionals master their finances so that they develop a roadmap to wealth creation and financial independence.

Financial freedom is possible for those who believe. I look at the totality of wealth and not just numbers. Numbers tell you a story, it shows you patterns, mindset, and behaviour. Persons who engage with my content love the fact that I break down complex financial concepts into simple, digestible, and understandable terms which is less scary as the topic of money can be emotionally charged.

Seeing the transformation in the lives of my clients reminds me of the importance of educating others on the topic of financial literacy and showing others how they can also become economically empowered.

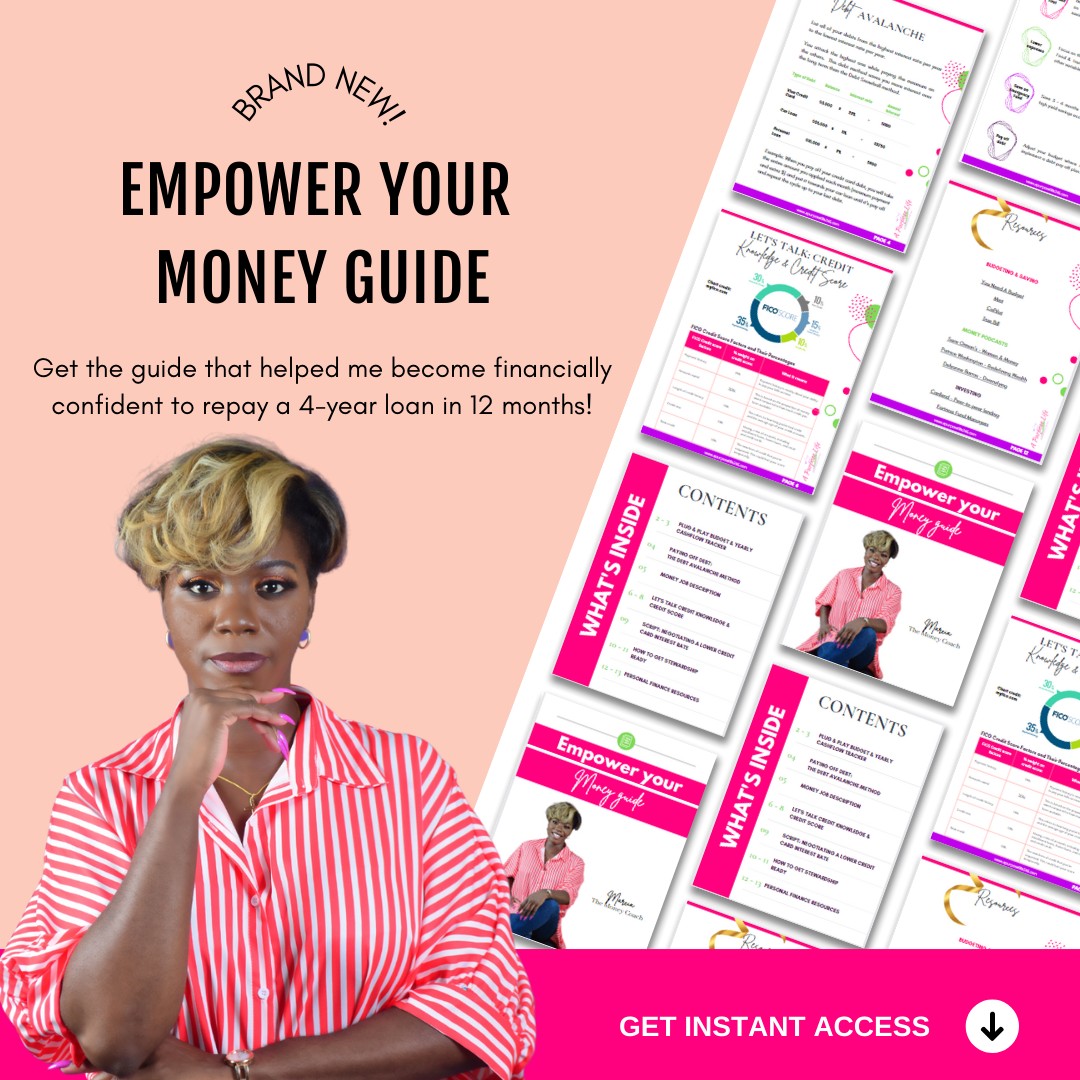

My services include coaching, corporate training, done-for-your services, and DIY services in the areas of money mindset, budgeting, debt repayment, and saving. I will soon be launching my first online personal finance course called The Wealthy Millennial Society. Join the waitlist here: https://apurposelife246.com/millennial-society/

Are there any books, apps, podcasts or blogs that help you do your best?

I have read 13 books for the year thus far, and I recommend the following if you’re new on your money journey:

– Total Money Makeover by Dave Ramsey

– Get Good with Money – Tiffany Aliche

– Profit First by Mike Michalowicz

– Millionaire Next Door by Thomas J. Stanley Ph.D., William D. Danko Ph.D

– You Are A Badass At Making Money by Jen Sincero

Podcasts:

Redefining Wealth by Patrice C. Washington

Suze Orman’s Women & Money

Traffic, Sales, and Profit Show by Lamar Tyler

Pricing:

- DIY Debt Defeater Kit – USD$27.00

- Success, Wealth & Prosperity Bundle – USD$47.00

- 1:1 60-min Financial Consult – USD$97.00

- One-Time Budget Plan (1 year) with 2 revisions – USD$127.00

- VIP Day with Marcia (up to 5 hours) – USD$597

Contact Info:

- Website: www.apurposelife246.com

- Instagram: https://www.instagram.com/a.purpose.life/

- Facebook: https://www.facebook.com/apurposelife

Image Credits

Image Credits

Andrew O’Dell – Design Central Studio Akeem Chandler Prescod – Stoned with Cupid