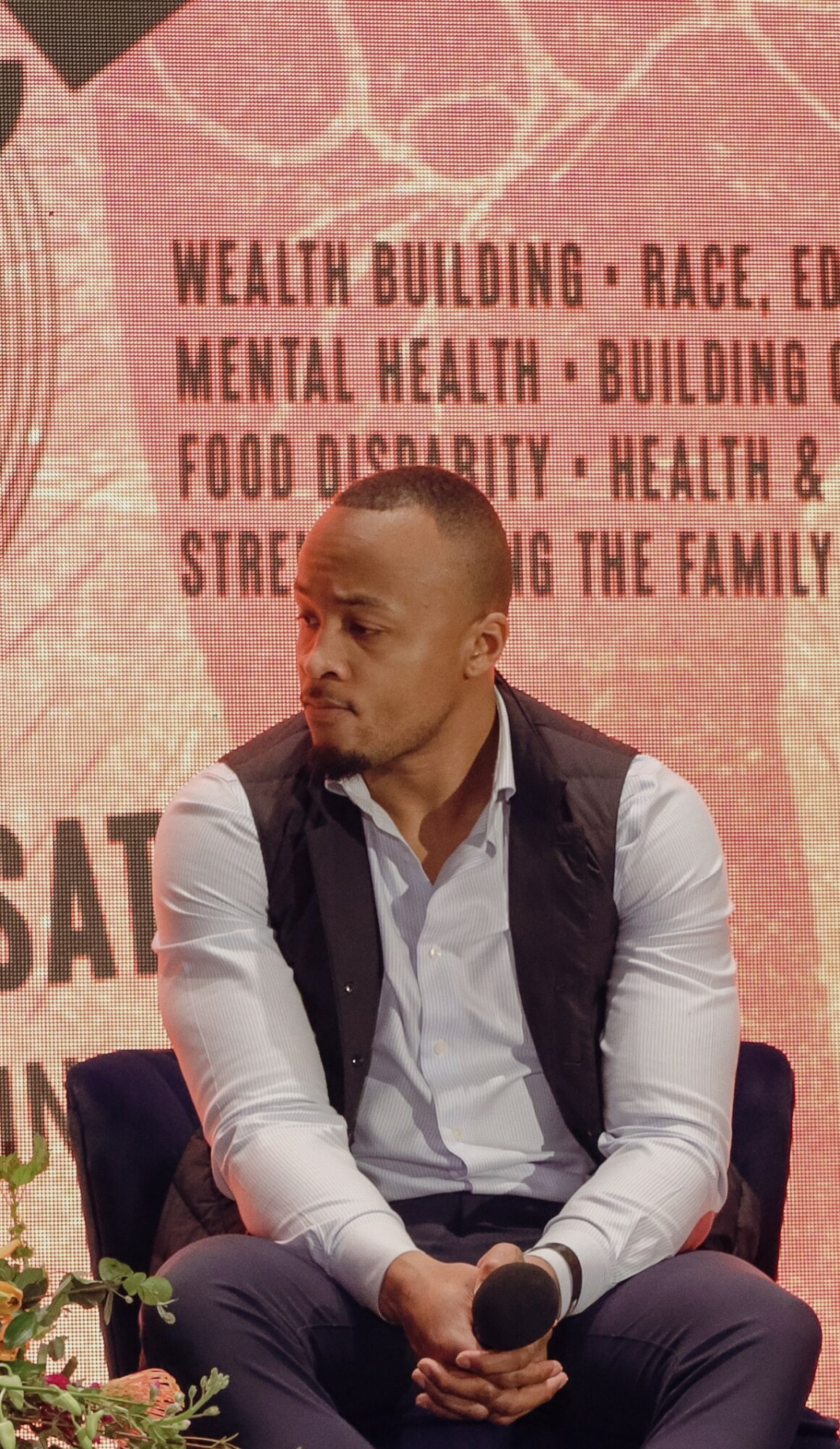

Today we’d like to introduce you to Rush Imhotep.

Hi Rush, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

I started my career with Northwestern Mutual as an intern in the summer of 2015. This was in New York City, my hometown, and candidly I primarily did the internship to get my mom off of my back about not having one. Nonetheless that internship evolved into a job offer, which ironically, I declined.

At the time I was a student-athlete who aspired to play football professionally, and I did not envision how a career in financial services fit into that. Yet three years and many injuries later I ultimately returned to Northwestern in 2019/2020. Thus far, I have been both overwhelmed and underwhelmed with the success that I’ve had in my practice.

Overwhelmed in the sense that I could never imagine being in this position financially without football, but underwhelmed in the sense that there are still many more things that I’d like to accomplish that are much greater than what I’m doing now.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

Starting a business is rarely smooth. The early years are often riddled with delay, disappointment, and rejection. That said, I’d argue the three years prior, where I spent 1095 days getting rejected by virtually every NFL and Canadian team, prepared me for those challenges and made me resilient in ways that I appreciated once I started on my own. Following the adage — “it doesn’t get easier, you just get better,” I believe my previous experience uniquely prepared me to deal with the early difficulties of starting in this business.

Thanks – so what else should our readers know about Northwestern Mutual Goodwin Wright?

We are a wealth advisory group that has partnered with Northwestern Mutual to provide financial planning services. The three biggest problems we’re helping our clients solve: are how do they pay less in taxes, how do they make sure they never run out of money, and with whatever money is left over, what is the most efficient way to transfer it?

What sets us apart is our philosophy around radical transparency and honesty. I am most proud of the people that I work with, and I hope anybody reading this article will get a sense of what it’s like to work with me and our firm.

What sort of changes are you expecting over the next 5-10 years?

Like everything else, I think artificial intelligence will have a massive impact on our industry. I envision a future where advisors leverage themselves using those tools allowing them to serve more clients, more frequently, and more quickly. I also envision a future where more high-touch advisory services can be offered to clients who don’t necessarily have gobs of wealth to manage and invest but still need sound planning.

Contact Info:

- Website: https://www.northwesternmutual.com/financial/advisor/rush-imhotep/

- Instagram: https://www.instagram.com/rush.gram/

- Facebook: https://www.facebook.com/rush.metapage

- Linkedin: https://www.linkedin.com/in/rush-imhotep-22033249/

- Twitter: https://twitter.com/RushImhotep