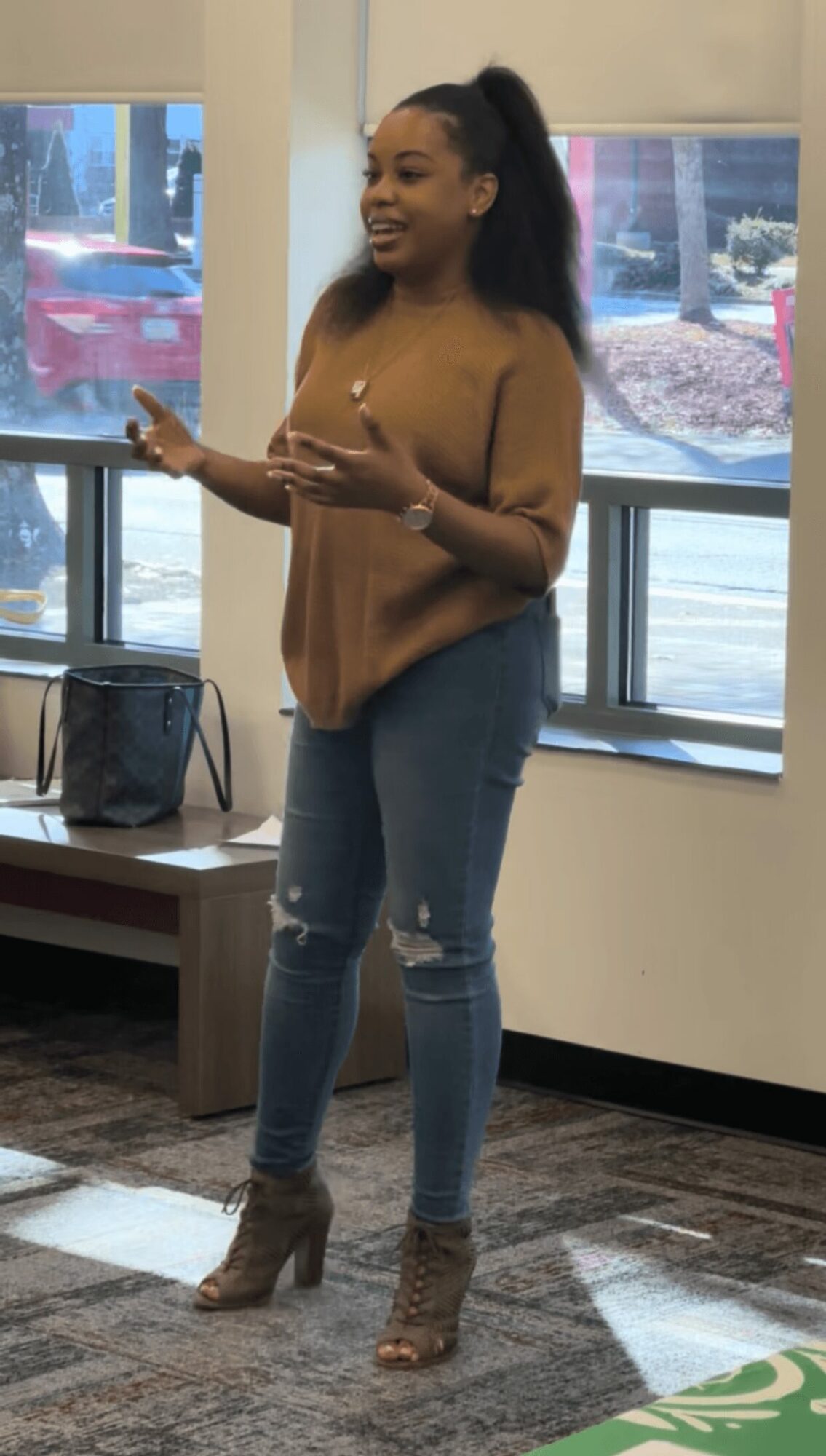

Today we’d like to introduce you to Taylor Thomas

Hi Taylor, we’d love for you to start by introducing yourself.

I’ve always had a love for numbers. My mother taught me my 2 times tables and how to balance her checkbook before I started school. Naturally math became my favorite subject. I graduated from Tennessee State University in Nashville, TN where I received my bachelors in Business Administration and Accounting. After graduation I went straight into the work force. I have a 10 year background in corporate accounting. Midway in my corporate career I realized I wasn’t enjoying my time in the accounting field. I was becoming less and less of a fan of the monotony the accounting world provided. I worked with several Fortune 500 Companies but those big names weren’t providing the fulfilling life I always envisioned for myself.

In 2023, I picked up a book titled The Black Girls Guide to Financial Freedom by Paris Woods. In this book the author provided a roadmap to mastering your money, taught you how to build wealth, and live life on your own terms. This book held a lot of great financial tips that the masses should know, but also tips I myself already knew, and most I already practiced. This book was the lightbulb in my head saying, “I can do that!”.

For years, I’ve set financial goals, saved and managed my money in ways that has allowed me to enjoy my life. I am even the friend that people ask questions about money, credit, saving, etc. but I cannot take all the credit for being financially knowledgeable. I have great parents who provided my financial foundations growing up. My mom taught me to always save for a rainy day and my dad taught me to pay yourself first. Two very simple, yet powerful, lessons in money management that had me practicing the art saving money since the 6th grade.

The pairing of my parents financial foundations and Pairs Woods’ book sparked something in me that I knew was possible, becoming a financial educator and financial coach.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

My biggest obstacle has been balancing a 9-5 lifestyle with something that I have now found passion and joy in. Office life is draining and robs me of my time and creativity. I’ve had to take a leap of faith knowing that this work is bigger than myself. I realize how much of an impact and how important this work is for my community which is why I’ve chosen to leave Corporate America and become a full-time entrepreneur. The next biggest obstacle is just getting the word out that this work is being done and we don’t have to be in the fight between life and money forever. There’s a game being played by the 1% that we can get in on too.

Thanks for sharing that. So, maybe next you can tell us a bit more about your business?

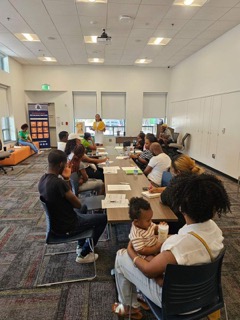

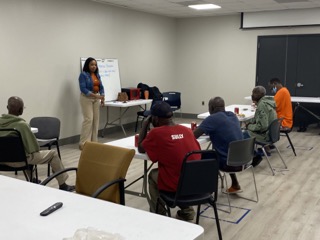

I founded Journey Through Finance, a financial services firm that provides financial education workshops, group coaching, 1-on-1 coaching, life insurance and retirement planning. The Journey Through Finance begins with deciding you need a change in your life and in the relationship you have with your money. We begin by visualizing your ideal reality, or your dream life. You’ll never make it to your destination if you don’t know where you’re going. We all hold a life of our dreams in our hearts and those dreams are not as far fetched as we may think. All it takes is shifting your mindset from what you see right now to what is possible in the future. We start this work starts at the very beginning by pairing your learned money experiences to how you view and use money today. Making those comparisons will help begin the shifting of your money mindset and how you use your money on a day to day basis. Once we shift our money mindset we can now work on the intricacies that come with money management, saving, budgeting, debt management, building credit, understanding investing, and retirement planning.

Within the last year Journey Through Finance has helped clients pay off $8K worth of credit card debt, pay off cars in full, purchase their first home, and build their confidence to ask for an increase in salary and promotions at work. I am currently working with the author of The Black Girls Guide to Financial Freedom, Paris Woods, in a program that helps college students who are parents manage and multiply their finances. At this time, Journey Through Finance offers financial education workshops and 1-on-1 coaching with clients. At the top of 2025 will be launch of a group coaching program Personal Finance 101.

Where do you see things going in the next 5-10 years?

The financial space is booming right now. There are lots of people in this field eager to get the knowledge out to the masses. In the next 5-10 years there will be a wealth of knowledge shared by experts to our community, specifically, and we will save and invest our money in ways that will include us in that 1%.

You can follow me on Instagram @FinancialCoachTaylor and subscribe to my YouTube Channel @JourneyThroughFinance.

Pricing:

- Discovery Calls $Free.99

- 1-on-1 Coaching reach out for package details

- Webinar Workshops $30 via Eventbrite

- Personal Finance 101 $750/person

Contact Info:

- Website: https://jtfinance.wixsite.com/home

- Instagram: https://www.instagram.com/financialcoachtaylor/

- Facebook: https://www.facebook.com/journeythroughfinance

- Youtube: https://www.youtube.com/@JourneyThroughFinance

Image Credits

Nostaljic Photography LLC

@NostaljicPhotography