Malika Daniels shared their story and experiences with us recently and you can find our conversation below.

Hi Malika, thank you so much for taking time out of your busy day to share your story, experiences and insights with our readers. Let’s jump right in with an interesting one: What is something outside of work that is bringing you joy lately?

Lately, I’ve found so much joy in something I picked back up from childhood—piano lessons. I dabbled in it as a kid, but like many things, it fell away as life got busier. Now, returning to it as an adult feels both grounding and refreshing. My teacher challenges me to stretch and improve, and right now I’m really enjoying playing and singing ‘Save Me’ by Jelly Roll. Practicing at night has become a calming ritual, and what surprised me most is how it’s turned into a family moment too—my kids love to sing along while I play. It’s been a beautiful, unexpected way to slow down, grow, and connect with them.

Can you briefly introduce yourself and share what makes you or your brand unique?

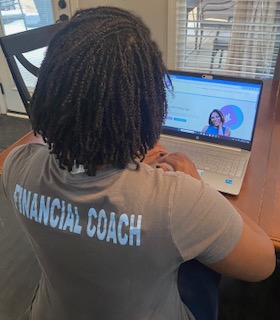

My name is Malika Daniels, and I’m the founder of Women Who Money Plan, where I coach women to build strong financial foundations and create money plans that truly work for their lives.

My passion for this started early. I grew up with a single mom who carried the weight of financial stress, and it taught me to value saving, avoid debt. When I met my husband, he had $60,000 in student loans while I had graduated college debt-free. Together, we created a plan and paid off his loans in just two years, which demonstrated to me the power of taking control of your money. After paying off the debt, our focus turned to building wealth—being intentional with our spending, avoiding high-interest debt, keeping our savings strong, investing regularly, and even investing in real estate.

Through my 1:1 coaching program, Money Makeover, I not only help you develop personalized plans for debt payoff and savings, but I also focus on mindset and helping women improve their relationship with money. One thing that makes Women Who Money Plan unique is that it’s not about shame or judgment—it’s about giving women the clarity, confidence, and tools to take control of their finances and create the future they want. We all have an idea of the things we “should” be doing with our money. I’m here to help keep you accountable to ensuring you actually achieve your goals.

Great, so let’s dive into your journey a bit more. What was your earliest memory of feeling powerful?

My earliest memory of feeling powerful takes me back to middle school. I was the youngest of four children, and I watched my mom work tirelessly to care for us while juggling the tough decisions of which bills to pay each month. I can still remember the phone ringing with bill collectors asking for her.

That’s when I started babysitting and earning my own money. I kept my savings tucked away in my dresser drawer, and before long, my mom would sometimes ask to borrow from me to help catch up on bills. I never minded lending her the money—she always made sure to pay me back—but what stuck with me was the feeling of being able to contribute. At such a young age, I realized the power of having money set aside. Not only did it give me a sense of independence, but it also allowed me to help my family when it mattered most. That experience planted the seed for my love of saving and shaped the way I see money today—not as just dollars, but as a tool for security, freedom, and even generosity.

When did you stop hiding your pain and start using it as power?

I experienced a traumatic pregnancy loss at five months with my daughter, and it was the hardest pain I’ve ever faced. What made it even more difficult was that it wasn’t the type of loss people openly talk about. For a while, I carried that grief quietly, but eventually I found the courage to share my story publicly. What I discovered was powerful—there were so many others who had walked the same path, and by speaking openly, we no longer had to feel alone. We could support and strengthen each other because we weren’t hiding our pain anymore.

That experience taught me an important truth: silence keeps us stuck, but sharing can heal. I see the same pattern with money—so many people struggle in silence, weighed down by shame. But when we start talking about it honestly, we create space for connection, learning, and ultimately, transformation.

So a lot of these questions go deep, but if you are open to it, we’ve got a few more questions that we’d love to get your take on. What’s a belief or project you’re committed to, no matter how long it takes?

I’m committed to doing my part to reduce the gender and racial wealth gap. There are so many financial realities outside our control—things like the gender pay gap, women stepping out of the workforce to care for their families, and systemic injustices that limit opportunity. But what we can control is how we actively participate in our money: spending less than we earn, saving, and investing the difference.

Unfortunately, high-interest credit card debt keeps so many people stuck, eating away at their ability to build real wealth. That’s why I’ve made it my mission to help women break free from that cycle. My personal goal is to help clients collectively pay off $1 million in credit card debt. So far, I’ve guided women in paying off over $200,000—and this is only the beginning. No matter how long it takes, I’ll keep pushing toward that mission, because every dollar of debt paid off is another step toward freedom and closing the wealth gap.

Okay, we’ve made it essentially to the end. One last question before you go. If you retired tomorrow, what would your customers miss most?

If I retired tomorrow, I think my clients would miss the support and accountability I provide—without judgment. So many of us carry shame about financial mistakes or feel embarrassed for not having learned how to manage money sooner. My clients know they can come to me and be completely honest about their struggles, and instead of judgment, they’ll receive understanding and encouragement.

I believe it’s important to acknowledge the past, but not get stuck there. What matters most is learning from it and then taking the next step forward. That’s why I’m always nudging my clients to take action and celebrating them along the way. For them, it’s about so much more than financial literacy—it’s about having someone who believes in them, helps them stay accountable, and reminds them that every step forward counts.

Contact Info:

- Website: https://www.womenwhomoneyplan.com

- Instagram: https://www.instagram.com/womenwhomoneyplan/

- Linkedin: https://www.linkedin.com/in/malika-daniels-afc/

- Facebook: https://www.facebook.com/womenmoneyplan/