Today we’d like to introduce you to Bill Hampton.

Hi Bill, it’s an honor to have you on the platform. Thanks for taking the time to share your story with us – to start maybe you can share some of your backstory with our readers?

I was born and raised in New Jersey.

In the 1990s, I started working on Wall Street as a licensed financial advisor for several firms.

While working on Wall Street, I became a part-time theater actor. How I became an actor is a great story. I called a local theater company to get tickets to one of their plays, and I ended up getting a lead part in the play because someone dropped out. True story. Over the course of the next decade, I appeared in over twenty stage productions in New Jersey and New York. I performed with some of the top Black theater companies in New York City, including the National Black Theater and the Frank Silvera Writers’ Workshop. Oh, and I did all of this without taking any acting classes.

In 2007, I relocated to the Atlanta area.

In 2010, I started an accounting and tax return preparation firm with a business partner while working my full-time job. We had several staff and offices in Atlanta and Stockbridge, GA.

In 2010, I also became a real estate investor and started buying rental properties.

In 2014, I started my own virtual tax return preparation, financial planning, and business consulting firm, while still working my full-time job. I felt that a virtual firm was a better business model and the future of the industry.

In 2014, I also became a volunteer speaker/educator for the Georgia Real Estate Investors Association (GAREIA). I still volunteer to educate members on tax strategies for real estate investors.

In 2016, I rebranded my firm to Hampton Tax and Financial Services, LLC. As my firm began to grow, I hired remote staff to assist with preparing tax returns.

My firm now provides the following services virtually: Business Entity Selection and Formation, Individual Tax Return Preparation, Corporate Tax Return Preparation, Credit Score Management, Tax Planning, Financial Planning, Education Planning, Retirement Planning, Estate Planning (Wills and Trusts), Life Insurance, Cost Segregation Services and Business Consulting.

In 2020, I retired from my day job and started running my firm full-time.

In 2020, I also started volunteering for the Score.org Atlanta Chapter. Score is a volunteer organization that mentors business owners and entrepreneurs. I was the Vice Chairman of the Atlanta chapter and a member of the National Diversity, Equity, and Inclusion (DEI) committee from 2021 to 2023. I still volunteer with Score.

In 2021, I joined the National Association of Personal Financial Advisors (NAPFA) and became a member of their DEI committee. In 2022, the DEI committee won a financial industry award for creating the first DEI certification program for financial advisors.

Over the years I have appeared in numerous publications and podcasts including NerdWallet.com, Yahoo News, Financial Planning Magazine, Black Enterprise Magazine, CreditCards.com, the Henry Herald and the Henry Neighbor.

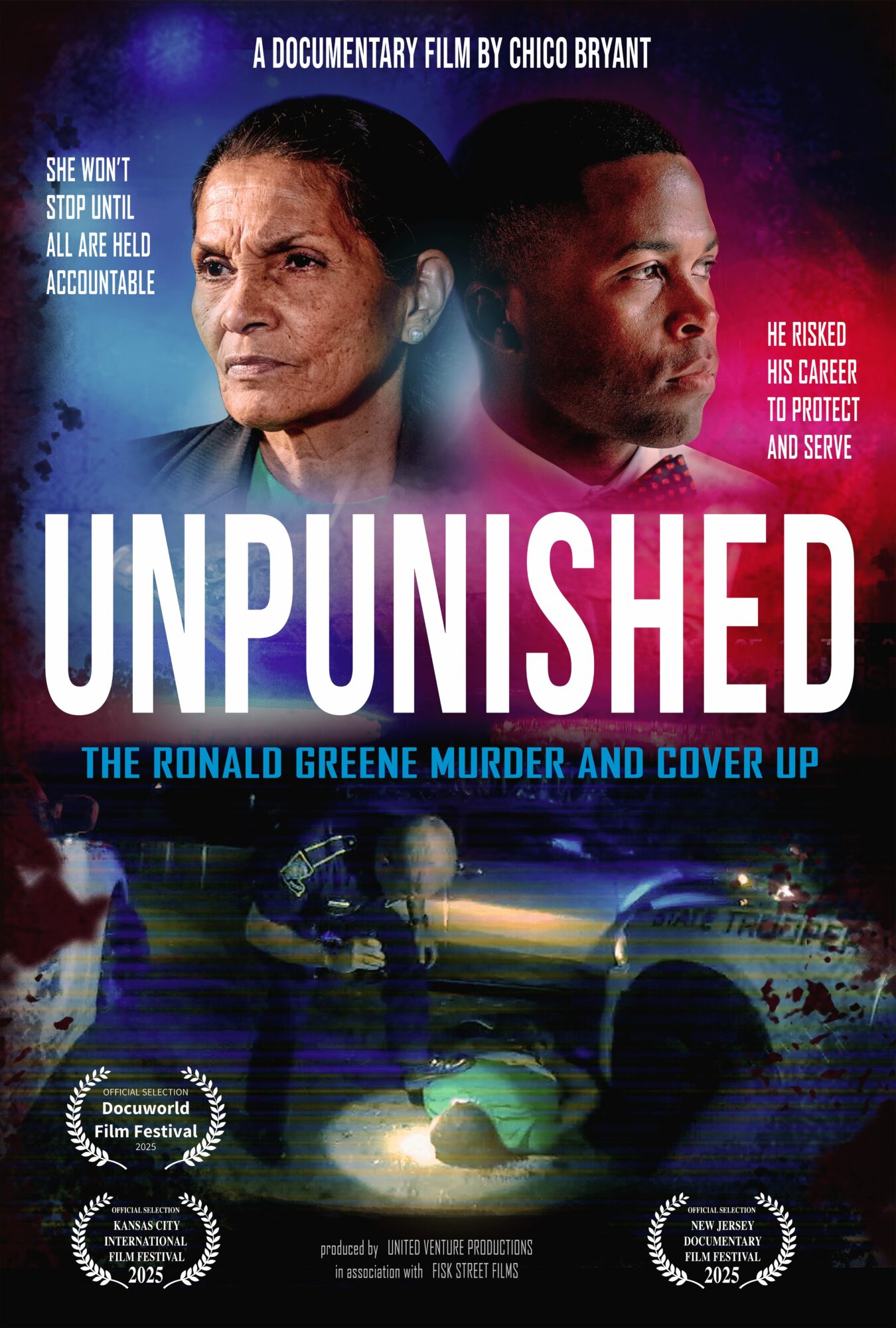

In 2022, I started a film production company and became the executive producer of a documentary film titled “Unpunished.” The film is about Ronald Greene, a black motorist who was killed by the Louisiana State Police in 2019. The film covers his murder, the police cover-up, and his mother’s fight for justice. The film has been accepted into two national film festivals and one international film festival. We are working on a distribution deal for this film.

Our second documentary film is about the “Goon Squad” a group of Mississippi police officers and sheriff’s deputies that assaulted two black men and shot one in the mouth in 2023, because they were living with a white woman. This film is in post-production and will be finished later this year.

In my spare time I love to travel and listen to live music.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

My greatest struggle as a business owner working a full-time job was time management. There weren’t enough hours in the day to do everything. Once I realized this, I decided to hire remote staff. It was the best decision I ever made. It allowed me to grow the business and delegate some of the work. This is probably the most important lesson for a business owner. You can’t grow and become successful without a team.

Appreciate you sharing that. What should we know about Hampton Tax and Financial Services, LLC?

Hampton Tax and Financial Services, LLC, a comprehensive financial services firm that provides the following services: Business Entity Selection and Formation, Individual Tax Return Preparation, Corporate Tax Return Preparation, Real Estate Investor Tax Return Preparation, Real Estate Agent Tax Return Preparation, Partnership Tax Return Preparation, Prior Years’ Tax Return Preparation (Back Taxes), Tax Return Check-ups, Credit Score Management, Tax Planning, Financial Planning, Education Planning, Retirement Planning, Estate Planning (Wills and Trusts), Life Insurance, Cost Segregation Services, and Business Consulting to clients nationwide. We specialize in real estate taxation.

I have appeared in numerous publications and podcasts including NerdWallet.com, Yahoo News, Financial Planning Magazine, Black Enterprise Magazine, CreditCards.com, the Henry Herald and the Henry Neighbor.

I am a Certified Financial Education Instructor (CFEI), a Registered Financial Consultant (RFC) and an IRS registered tax preparer. I am currently studying to become a Certified Financial Planner (CFP).

I am a member of the National Association of Personal Financial Advisors, the National Association of Tax Professionals, and the Georgia Real Estate Investors Association. ,

Where we are in life is often partly because of others. Who/what else deserves credit for how your story turned out?

My biggest supporters and cheerleaders are my parents and my sister. My mom and dad were business owners and real estate investors while I was growing up and I followed their lead. They have been there from the beginning and continue to support and inspire me.

Pricing:

- Hourly tax planning: $350/hr.

- Tax return check-ups: $350

- Tax return preparation: varies by complexity.

- Revocable living trusts: $1,999

- Annual tax planning/financial planning: $2,999 for 12 months, which includes unlimited consultations.

Contact Info:

- Website: https://www.HamptonFinancialLLC.com

- LinkedIn: https://www.linkedin.com/in/billhamptonfinancialadvisor/

- Other: https://charlesbenn.wixsite.com/unitedventure