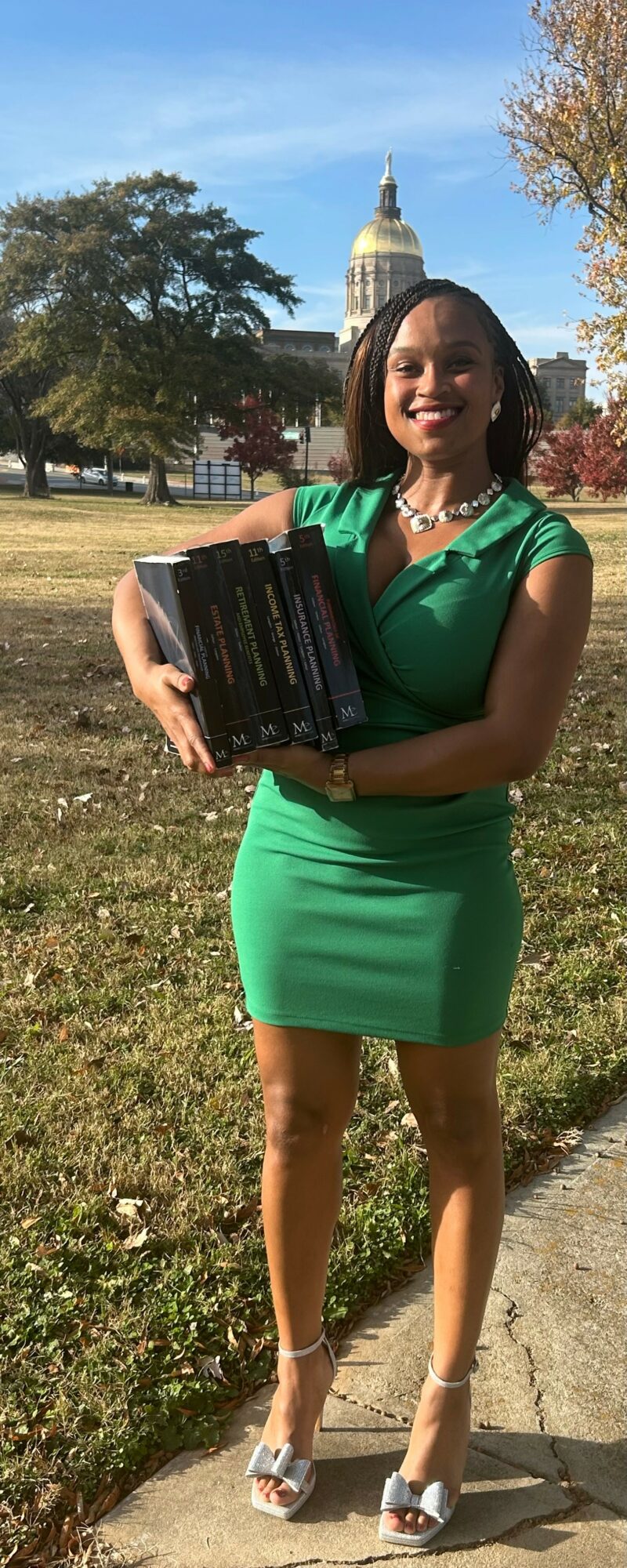

Today we’d like to introduce you to Bria Clark.

Hi Bria, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

The essence of my contribution to the world is helping people claim their financial power. I still remember the exact moment it clicked— junior year at Berkmar High School, sitting in class, eyes filling with tears, as I absorbed the truth behind the Life and Debt narrative—my first real “Aha” moment. Systematic oppression is embedded in global financial agreements; these mechanisms create long-term financial stagnation that stifles real progress and reinforces a pattern of organized monetary cruelty that benefit powerful institutions at the expense of everyday people.

That clarity only deepened as I watched the 2009 U.S. recession unfold around me, with massive job losses, collapsing home values, and families across America grappling with either unemployment or income sluggishness; it proved that economic suffering isn’t isolated to one nation, but part of a broader pattern of systemic vulnerability. Absorbing the weight of the documentary’s lessons was painfully real, revealing that oppression isn’t just global, it mirrored the struggles unfolding around me. It exists across all neighborhoods, households, and generations.

Understanding both Jamaica’s struggles and America’s economic downturn strengthened my commitment to advocate for economic empowerment, resilience, and financial justice wherever I serve. To add meaningful value to this fight, I needed a strong education and access to an environment rich in opportunity and capital—so I headed to our nation’s capital, Washington, DC, to study finance at Howard University. From that moment, I made it my mission to save myself and help people escape those same patterns in their own lives!

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

Financial triumphs and setbacks aren’t just concepts to me—they’re part of my story. As I share the challenges I’ve faced, I encourage readers to focus on the solutions I offer. Pay more attention to the pivot than the problem—because life is about balance, and every problem has a solution.

The Survival Instincts

The first pecuniary hurdles appeared in college—figuring out how to get there, stay there, and ultimately leave with a degree. As an out-of-state student attending a private university, I faced limited financial aid and the heavy burden of student loans.

Being a full-time student in the College of Business, I was required to participate in the 21st Century Capstone Program, which left no time for a traditional part-time job. There I was—a broke college student. To make ends meet, I launched a dorm-room hair styling business and hosted bake sales throughout campus. Those actions put immediate cash in my hands. I always encourage others: tell people what you’re good at—then charge them for it.

When it came to paying for my education, I constantly had to close the financial aid gap. I searched for internships and full-time positions weekly, keeping my résumé in circulation, applying to 10–20 jobs a week. It takes a lot to get in front of the right opportunities, so I treated applying like a job-in-itself.

I understood that great companies invest in students and often give back to the community. That’s when I began looking toward corporate sponsorships and committed to applying for at least 2–3 scholarships each week. The key is to plan-ahead. For example, look for scholarships for “seniors” while you’re still a “junior”—that way, you’re already ahead of the game. I’d mark application requirements and deadlines on my calendar and get busy applying in the upcoming semesters.

Another important tip: perform well in your first semester so you can use those grades to apply for scholarships in the second. Pulling your GPA up later is great—but having it “scholarship-ready” from the start is even better.

The same principle applies to jobs. Most employers hire before the break starts, so look for winter jobs in September or October to secure work over the holidays. Apply for summer jobs in March or April, so by May, you’re already on the schedule.

The way internship checks hit, I’d work all summer for a bigger bag, then use that money to pay registration for the upcoming semester. I’d stack cash during the summer to cover fall tuition, and work through winter break in December to pay for dorm fees and books in January.

Between juggling academic deadlines and stretching every dollar, I developed what I called a “funding cycle.” I mapped out scholarship deadlines on my calendar and researched high-earning career paths. It was a strategy that required staying ahead of deadlines and maintaining a consistent routine. Navigating those hardships became a masterclass in resilience.

The Corporate Struggle

The second pecuniary hurdle came as I entered the workforce—but this time, the battles were stacked. I was making money, but I couldn’t retain it. Financially, I had to break free from the paycheck-to-paycheck cycle and learn how to navigate the tax system. Spiritually, I had to endure environments that prioritized productivity over potential. I felt like a sunflower in cement.

Like many graduates, I took a job for the money. I was grateful to provide for myself, but I hated the work. I was eager to get ahead, and that anxiousness made me an easy target for manipulation. My heart broke when I realized I was performing like a workhorse—chasing a carrot on a string. Overworking, volunteering, and people-pleasing only led to being passed over for promotions and promised things that never came.

Experience taught me to never rely on verbal promises—everything needs to be in writing. I learned not to seek external validation, and most importantly, I learned my creativity doesn’t come from a position, it’s something I cultivate independently.

I stepped back from the extra support I was providing in the office and redirected that time toward myself. I began building my online brand—posting consistently on my YouTube channel, Bria Clark, under the series title BRIALife—and growing my work outside the workplace. That’s when I started attracting my true audience: a community of people eager to learn about finance year-round. I also started posting on other social media platforms and engaging more intentionally with the people following my hashtags. Finding that connection and fulfillment outside of work eased a lot of the burdens I felt on the job.

During this time, my bills were paid, but my paycheck was eaten up by taxes, student loans, rent, and transportation costs. I was working at a job I didn’t like, to make money I didn’t really have. This is a classic cycle for many Americans. The system is designed to keep you one check away from being broke. I stopped chasing carrots and started relying on my own learning.

I took full advantage of every employee benefit available to me: employer-matched 401(k) contributions, employee stock purchase discounts, and access to corporate credit cards in my name.

I maximized my retirement contributions to the IRS limit, which supported my financial plan by lowering my taxable income—and in turn, reduced the amount of taxes I owed. Any extra money I earned from side hustles or work bonuses went straight to paying off high-interest unsubsidized student loans. The interest I paid on those loans was tax-deductible, which further decreased my tax liability while accelerating my debt payoff.

I paid all my bills using a personal credit card and paid it off in full each month. Because the company credit cards were in my name, the travel perks and reward points accumulated in my name too. After managing large departmental expenses on my corporate card, submitting reimbursements, and keeping the account in good standing, I called the same credit card company and requested a personal card with a matching limit. They reviewed my billing history and approved me for the same product.

Another credit tip: I routinely requested credit limit increases and used balance transfers to ensure my credit utilization stayed below 30%. These financial strategies helped me move from point A to point B on my journey to success.

I can’t say it was easy, but those moments taught me not to get comfortable. I stayed down until I came up. Breaking the generational curse of being bound by debt, I paid off my student loans completely. I maximized my retirement contributions, built an emergency fund, started trading stocks, and began to travel internationally. At that point, I quit my corporate job and went into business for myself. I did it. I escaped the hamster wheel.

The Cost of Being a Boss

The third pecuniary hurdle came when I launched my business—paying the cost to be the boss. I had laid the groundwork to pursue my own venture, and suddenly everything became “business plans this, business plans that.” The savings I had carefully built up were slowly being funneled into funding my dream. That was the price I paid to carve out my own path as an entrepreneur.

To fully commit, I gave up my apartment in D.C. and moved in with family—first in Illinois, then Florida, returning to states where I had a natural support system. I knew I’d need that network to carry me through the early days of building something from the ground up. This transition wasn’t just about saving money; it was about investing in the right environment to grow.

In Illinois, I gained hands-on experience and learned the value of mentorship. The financial lesson here is to invest in learning before earning. Real-world experience taught me how to manage money, negotiate contracts, and build sustainable business models. Whether through mentorship or hiring a coach, collaboration can accelerate your progress.

Florida reinforced another truth: financial decisions rarely affect just you. Living with family reminded me that shared responsibilities and emotional ties can complicate money matters. I learned to set boundaries, communicate clearly, and plan not just for personal gain, but for generational wealth.

Leaning on others taught me that financial growth doesn’t have to be a solo journey. Asking for help allowed me to conserve energy, avoid costly mistakes, and benefit from the wisdom of those around me. One of the most powerful lessons I learned was this: peace is expensive. And I paid dearly for it. The cost of growth— financial, emotional, and mental was real. But when you share the load with structure and support, it becomes more manageable.

Eventually, I made my way to California, where I faced the high cost of living and the unpredictable nature of entrepreneurship head-on. I secured an office on the waterfront, found the most affordable place I could in the Gaslamp District, and said, “Let’s go!” I relocated my finance practice to San Diego. I signed contracts, then faced client drop-offs, housing instability, and the rollercoaster of running a business. But every challenge became part of the solution.

What’s the financial takeaway? Budget for volatility. Whether you’re freelancing, relocating a business, or navigating a competitive economy, your financial plan must account for both feast and famine. Flexibility and foresight aren’t optional, they’re essential.

The Home Office Trials

The fourth pecuniary hurdle was met rebuilding in Georgia. Upgrading my social life and jumping professional levels brought radical changes that took me across Atlanta. I relocated, finished my certification courses, and gained the knowledge I needed to keep going. But knowledge alone isn’t enough—your environment matters just as much as your effort.

When I moved to Atlanta, I was ready for a new level. I was “outside” and in everybody’ face. I commuted across the city—chasing connection and community. My time was deeply rooted in communities across the greater Atlanta area, including neighborhoods such as Fairburn, Adamsville, Bankhead, Vine City, West End, Grove Park, East Point, Sandtown, Cascade, Ben Hill, Greenbriar, Princeton Lakes, Mechanicsville, Capitol View, Grant Park, Reynolds town, Midtown, Inman Park, Old Fourth Ward, Cabbage town, Edgewood, Kirkwood, and East Atlanta Village. My activity area also extends to surrounding areas like Stonecrest, Lithonia, and the Panola Road corridor, as well as every public library in both DeKalb and Fulton County, which serve as vital hubs for learning, access, and community connection.

I met a lot of people, but overtime, I realized most of them were just talking. Big dreams, no follow-through. Here’s the truth: bad company corrupts good morals—and it can bankrupt your future. The people you surround yourself with influence your mindset, your habits, and your hustle. If you’re around people who don’t value discipline, growth, or financial responsibility, you’ll find yourself drifting off course. Protect your peace. Protect your process.

The lesson? Your environment can either elevate you or drain you. Choose wisely. And financially, always build with flexibility. Have a plan but leave room to pivot. Because success isn’t just about how much you earn—it’s about how well you adapt, who you align with, and how you protect your peace along the way.

When life changes— so should your strategy. True financial growth requires adaptability. Sometimes, you’ll have to start over, rebuild from scratch, and do it with better tools and sharper insight. That’s why having a buffer—an emergency fund or financial cushion—is essential. It gives you the freedom to pivot without panic. And sometimes, the most powerful reset is letting go of bad habits, toxic money mindsets, or even failed ventures.

Today, I’m grateful for the opportunity to help people build stronger financial futures. Those obstacles I overcame didn’t break me—they built the blueprint. They taught me that success isn’t pre-recorded; it’s engineered—by learning to recognize the problem, understand the system, and work strategically to rise above both.

As you know, we’re big fans of BRIA CLARK, A FINANCIAL POWERHOUSE. For our readers who might not be as familiar what can you tell them about the brand?

I develop customized financial plans that empower individuals and businesses to navigate life’s key transitions with clarity and confidence.

– Need a full financial roadmap? I create comprehensive plans and recommendations that bring structure, direction, and confidence to your long-term goals.

– Need ongoing guidance? I provide continuous text and email support to help you navigate day-to-day financial questions.

– Need clarity on a specific topic? I offer focused virtual or phone sessions where we walk through the financial concepts or decisions you’re facing.

– Need your ideas expressed professionally? I write finance blogs, articles, and polished papers that communicate your message with accuracy and impact.

What sets me apart is that my approach to financial advising is deeply personal, rooted in the understanding that every soul will face adversity, and true success lies in finding balance through life’s challenges. I’ve walked the same uncertain path many of my clients are on, from paycheck-to-paycheck cycles to building a thriving financial practice, my experience—has been shaped by resilience, resourcefulness, and a relentless commitment to economic justice.

Working with me means entering a partnership rooted in empathy, strategy, and lived experience. Whether you need a full roadmap, ongoing support, or just someone to help you make sense of a single decision, I’m here to guide you with clarity and care.

My passion for financial empowerment was born the moment I realized how deeply systemic oppression is woven into global and local economies. That’s why I’ve made it my mission to help people reclaim their financial power, especially those who’ve quietly endured economic setbacks and are ready to rise.

If you believe in the power of financial freedom and want to help expand this mission, your support—whether through referrals, donations, or collaboration, helps fuel a movement that’s changing the way people experience money, one life at a time.

Can you talk to us a bit about the role of luck?

I don’t really believe in good luck or bad luck—what I’ve learned is that life is shaped by consecutive good decisions, firm lessons, and the discipline to grow through every season. You forgive yourself, sustain yourself, and trust God deeply, refusing to lean on your own imperfect understanding. You submit to wisdom, honor the lessons that come your way, and resist every temptation that tries to pull you into a smaller, weaker version of yourself. And through it all, you give the glory to God—because every step forward reflects His guidance, not chance.

Pricing:

- Unlimited Text and Email Support: Access provided for a monthly fee of $16.20

- Virtual Consultations: Hourly rate of $36.50 for virtual meetings or phone discussions

- Content Creation: A flat fee of $92.00 per submission for finance articles or papers

- Comprehensive Financial Planning: Billed at $216.00 per hour to deliver a full plan

- Insurance Support Services & Tailored Financial guidance to meet your financial needs at every stage.

Contact Info:

- Website: HTTP://www.callbriaclark.com

- Instagram: https://www.instagram.com/callbriaclark?igsh=MW5wYjh2bXUwM3NxZw%3D%3D&utm_source=qr

- Facebook: https://www.facebook.com/share/1BszrQrAa5/?mibextid=wwXIfr

- LinkedIn: https://www.linkedin.com/in/briaclark?utm_source=share_via&utm_content=profile&utm_medium=member_ios

- Twitter: https://x.com/callbriaclark?s=21

- Youtube: https://youtube.com/@briaclark?feature=shared

- Other: Bria.Clark@AOL.COM

Image Credits

Miss Bria Clark & Capitol Gateway’s Very Own, “Black”