Today we’d like to introduce you to Niyi Adewole.

Hi Niyi, we’d love for you to start by introducing yourself.

In 2015, I was blessed with an opportunity to join a Fortune 300 healthcare company via an 18 months rotational development program. While in the program, I met individuals that had been with company for 30+ years steadily climbing the ranks, and on the surface, this looked like the definition of success. They had nice cars and beautiful homes, however, when I dug deeper and truly observed what was going on, most were operating with “Golden Handcuffs.” Lifestyle expenses had creeped to a level that they were dependent on this job to make ends meet, and at the same time, the job was demanding more and more of these individuals’ time to where they were literally working around the clock, fighting to make it to the next vacation or extended weekend.

Their well-being was highly dependent on how the companies balance sheet looked year to year, and in down years it was a scramble not to be on the “Q4 Overhead Cut” list. I could see very clearly what my lift could look like 30 years down the road and I made a decision to start taking steps to shift that trajectory. It was around this time that I re-read the books “Rich Dad, Poor Dad” and “Richest Man in Babylon”, and the true meaning of these books clicked. I was inspired to start building a life that I did not need to vacation from.

In 2016, I started funneling 70% or more of what I made into real estate investments, making mistakes and learning along the way. Initially, I was very reserved in discussing what I was doing, but as I started to see the benefits of this pathway, I began to encourage friends and family to do the same.

In a little over seven years I worked my way from a Development Professional to Director of Strategic Accounts responsible for building and maintaining C-Suite relationships within 10 of the top 100 accounts in the country while simultaneously building up a rental portfolio of 25 long-term rental units and 4 short-term rental units.

In February of 2021, I moved to Atlanta and launched “Ekabo Home” to help those that do not believe they were put on this earth to work 40 to 50 hours a week for 40 to 50 years achieve financial freedom well before the “Normal” age of 65+. In November of 2021, I obtained my realtor’s license in GA and in August of 2022, I was able to exit the corporate world and move into full-time real estate entreprenuer.

We all face challenges, but looking back would you describe it as a relatively smooth road?

The consistent paycheck received every two weeks is something that we all grow used to and leaving that security to move into full-time entrepreneurship was nerve-wracking.

As you know, we’re big fans of Ekabo Home. For our readers who might not be as familiar what can you tell them about the brand?

For those that are not of Nigerian descent, Ekabo home means “Welcome” in Yoruba. Our team is made of licensed realtors helping clients obtain financial freedom through real estate investing. What I love most about Ekabo Home is that our team members are on the same journey as our clients. We do not give advice or guide individuals based on theory but on actual experience of having taken these steps ourselves. For example one of the best ways to get started on the path to financial freedom is to flip your largest monthly expense into extra income via a “Househack”. I have helped a myriad of clients purchase homes with an in-law suite or other income suite (I.e., Duplex, Triplex, Quadplex) with this little is 3.5% down and significantly reduce their housing expense and in turn their dependence on a W2. I have been able to help clients do this because this is exactly how I got started.

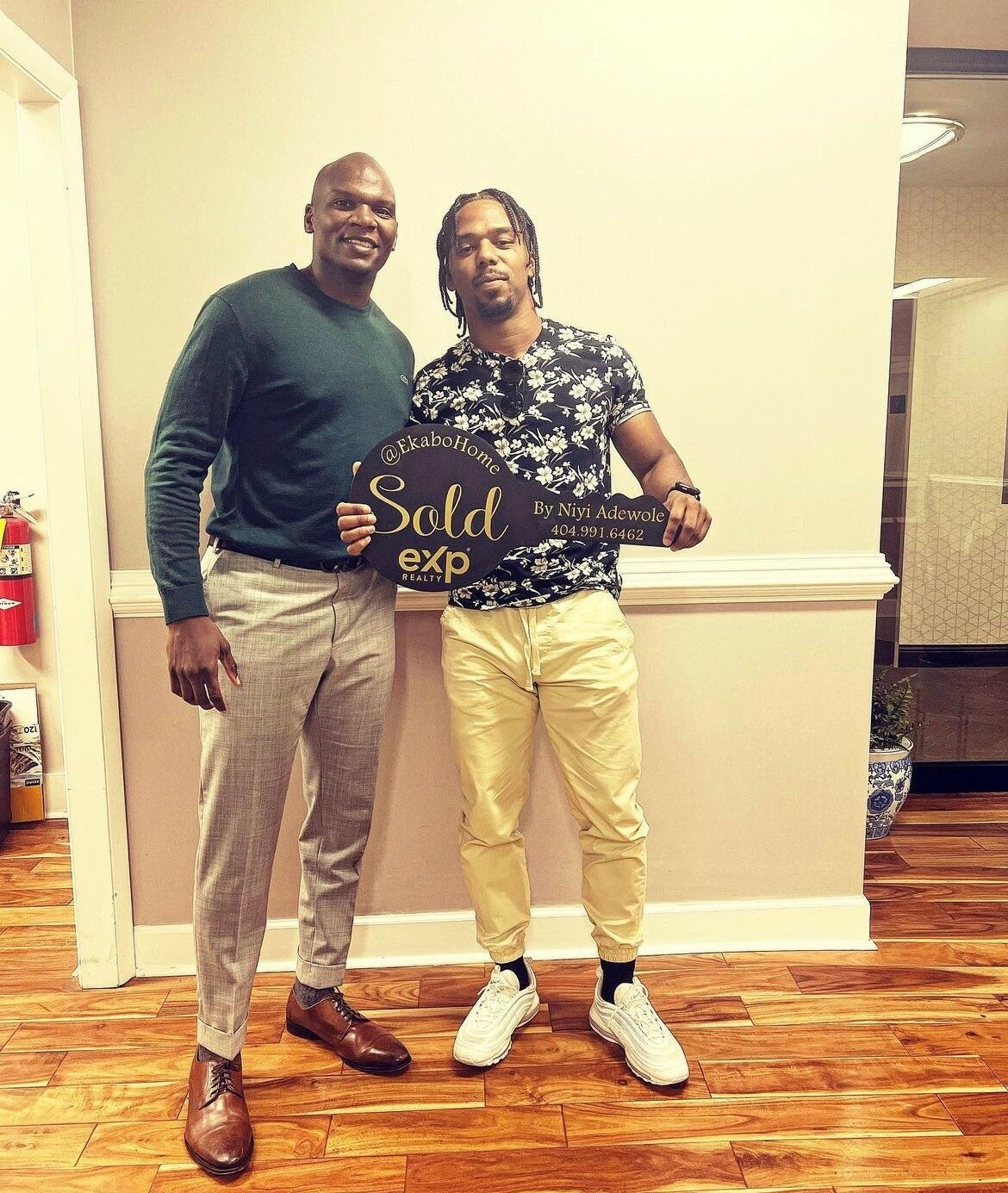

In 2016 I bought a triplex for 190K by putting a down payment of 3.5% or $5000 down. The mortgage was $1350 per month. I lived in one unit and rented the other two units out for $1400 a month effectively living for free. This allowed me to save what I was normally spending on housing for the next property/ investment which I purchased for the next year. Fast forward to 2021, I was able to sell that same house for $310,000 and reinvest the proceeds into two homes. Not bad for a $5000 investment. When clients close on a home with the Ekabo home team, we truly make it a celebration for them. We view this as one of the most important steps an individual can take toward becoming financially free and celebrate them as if it were their birthday handing keys to a client at the closing table is what we enjoy the most.

We are educated via our weekly financial freedom mastermind meetings/podcast, We help clients take action by identifying and taking down the ideal homes/investments, and we also have a Short Term/Mid-Term rental management arm that helps our clients manage the day-to-day on their investments.

What do you like best about our city? What do you like least?

Prior to moving to Atlanta, I had lived in Boston, Louisville, Chicago, Philadelphia, and Nashville. The richness of diversity and opportunity in this city is bar none, and I truly enjoy calling this city home.

Contact Info:

- Website: https://linktr.ee/ekabohome

- Instagram: @ekabohome

- Facebook: Ekabo home financial freedom mastermind group

- Youtube: https://www.youtube.com/channel/UCo-iogGt9tlPsMDFKB7B-1Q