Today we’d like to introduce you to Josh Lloyd.

Hi Josh, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

Our story really begins back in 2018, when Joe and I met working out at a local gym. What started as casual conversations about business and life quickly turned into deeper discussions about opportunities in real estate and finance. Joe brought decades of real estate experience — sourcing, structuring, and managing projects across different market cycles. I came from a technology and entrepreneurial background, having built and sold startups, and at the time I was also lending money privately — continuing a tradition as a third-generation lender in my family.

We realized right away that our skills complemented each other. Joe had an eye for strong real estate deals and borrower relationships, while I focused on building systems, processes, and a platform that could scale. Together, we saw a gap: investors wanted the stability of real estate-backed returns, but access was limited and the process was often opaque.

That was the spark that became Yieldi. We started small, funding deals directly and walking each investor through the process personally. As we grew, so did our conviction that we could marry trust, transparency, and technology to make investing in real estate lending more accessible.

Today, Yieldi has a platform with consistent deal flow, recurring revenue, and a growing community of investors. But at its core, it’s still rooted in the same foundation as when Joe and I first met in that gym: a genuine partnership, complementary expertise, and a shared belief that investors deserve straightforward, secure opportunities.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

t definitely hasn’t always been a smooth road. Like any entrepreneurial journey, building Yieldi has come with its share of challenges. In the early days, one of the biggest hurdles was trust. We were asking investors to put their hard-earned money into a new platform, and that meant we had to prove ourselves deal by deal. Joe and I personally walked investors through every detail, sometimes spending hours on a single call just to make sure they felt comfortable.

We also had a steep learning curve around fraud prevention. Anytime you’re in lending, there are people who will try to game the system. We had to build tighter verification processes, add layers of due diligence, and continually refine how we screened borrowers. Those lessons were sometimes costly, but they forced us to create stronger systems that ultimately protect our investors today.

As we grew, scaling brought its own challenges. Processes that worked for 10 loans didn’t work for 100. We had to invest in technology and process improvements to handle volume without losing the personal touch. And like any lender, we’ve faced the challenge of raising enough capital to move quickly when a great deal came across our desk. Early on, that sometimes meant passing on opportunities we knew were strong simply because we couldn’t fund them fast enough.

Balancing all of that — protecting against fraud, improving systems for scale, and making sure we had the capital to act decisively — has been a constant learning process. It hasn’t been easy, but each struggle has made Yieldi stronger, more resilient, and better positioned to serve our investors with consistency and confidence.

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

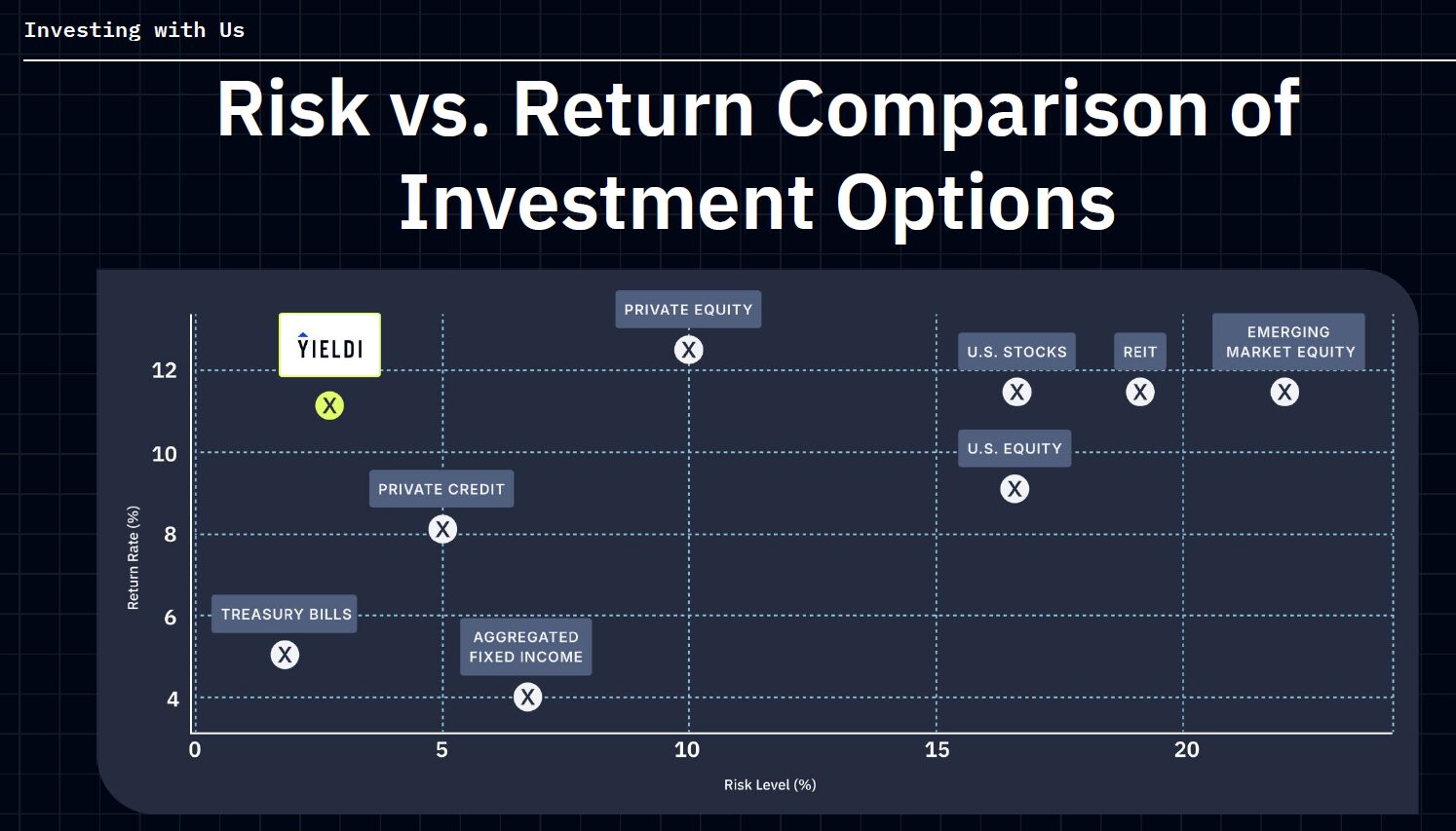

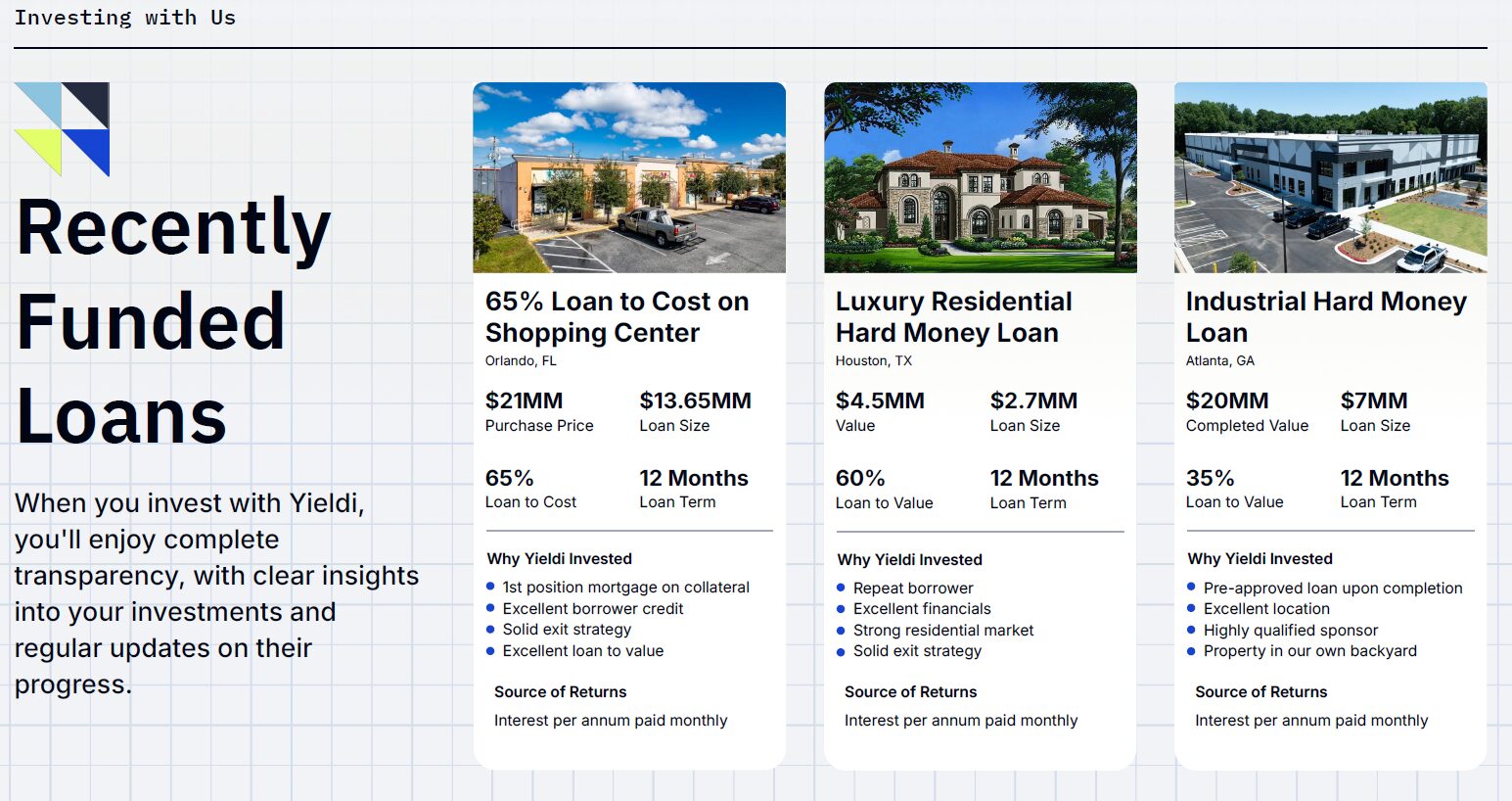

Yieldi is a real estate lending platform that gives accredited investors access to short-term investments secured by first-position liens on real estate. We specialize in offering consistent returns, averaging around 9.5%, while prioritizing investor principal protection. Unlike other investment options, we focus on transparency — investors can see the underlying collateral on every deal and know exactly how their money is working.

What sets us apart is the blend of technology and real estate expertise: my co-founder Joe Ashkouti brings decades of real estate experience, and my background is in technology and entrepreneurship. Together, we’ve built a scalable platform that still feels personal — investors can pick their deals, track performance, and know that their funds are backed by tangible assets.

We’re most proud of the trust we’ve built with our investor community. Many of our investors come back deal after deal because they see both the results and the consistency. At Yieldi, our mission is to make institutional-quality real estate lending accessible, secure, and transparent for individual investors.

In terms of your work and the industry, what are some of the changes you are expecting to see over the next five to ten years?

Over the next 5–10 years, I see private real estate lending moving from a fragmented, niche corner of finance into a more mainstream and institutionalized industry. Traditional banks have become so restrictive that they often only lend to people who don’t really need the money. That leaves a huge gap in the market for borrowers who have solid projects but don’t fit a bank’s increasingly rigid criteria.

At the same time, many investors are frustrated with banks, low yields, and the lack of transparency in traditional financial products. They’re actively looking for alternatives that can deliver consistent returns backed by real assets. That’s where private lending comes in — and it’s why the space has been attracting more institutional capital alongside individual investors.

At Yieldi, we’ve been able to fill this gap by creating a platform that gives accredited investors direct access to high-quality, secured real estate loans. We believe that as trust and transparency increase, private lending will become a core part of diversified portfolios, not just an alternative. The industry is maturing quickly, and the next decade will be about scaling, standardizing, and earning the same level of confidence from investors that banks once had.

Pricing:

- We pay our accredited investors 9-10% returns for first position mortgages

- Our borrowers pay around 12% on average

- We charge no fees to our investors, so this is a net return to them

Contact Info:

- Website: https://yieldi.com

- Instagram: https://instagram.com/yieldi_

- Facebook: https://facebook.com/yieldi

- LinkedIn: https://www.linkedin.com/company/yieldillc/

- Twitter: https://x.com/Yieldi4