Today we’d like to introduce you to Sabrina Rosa.

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

I started in this business over 10 years ago, when I was just beginning to truly understand credit and why it mattered. I remember trying to buy a car, and my credit was one of the main reasons I couldn’t get approved. At the time, I didn’t recall really applying for credit except once, when I was 18 and Chase Bank gave me a credit card with a $300 limit. Back then, I wasn’t very knowledgeable about business or credit, so I viewed it as “free money” and had no intention of paying it back.

That decision followed me for years. Every time I tried to apply for something, it came back to haunt me, and I eventually realized I needed to take action to fix it. I remember seeing an advertisement for credit repair and deciding to give it a try. However, I wasn’t seeing any real results, so I started doing my own research and eventually canceled my membership with the agency (which I won’t name, though I’m sure many others have had similar experiences).

Once I began working on my credit myself, everything changed. I successfully removed the Chase Bank credit card and all the inquiries from my credit report. From there, people—mostly family—started asking me how I did it and allowed me to work on their credit as well. As I continued using what I learned and saw consistent results, I turned it into a business and began charging for my services

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

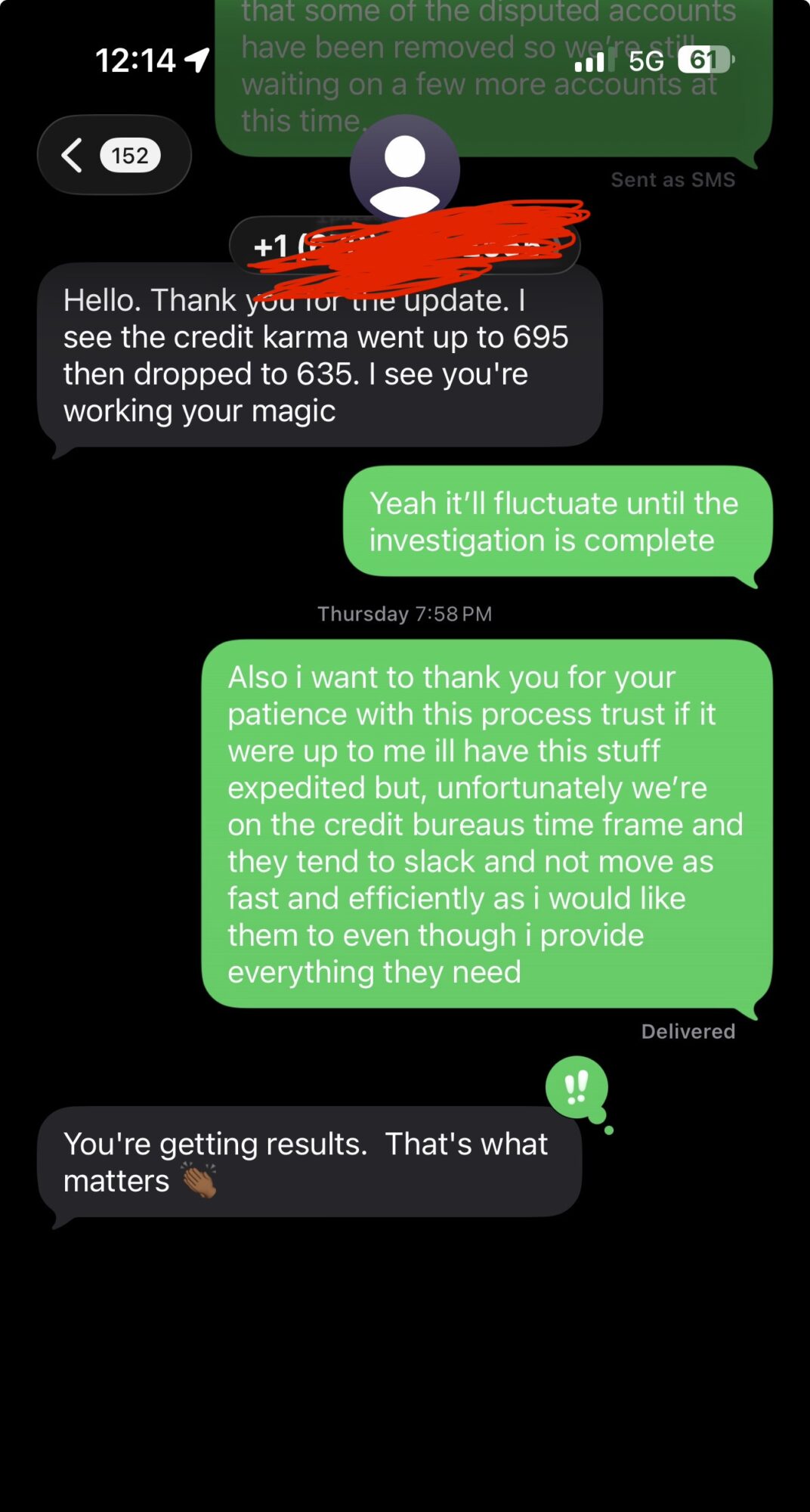

The road is what you make it, but the challenges I’ve faced throughout this journey have mostly involved dealing with the credit bureaus and credit furnishers. I say that because, although I make sure all my t’s are crossed and i’s are dotted, they sometimes fall short in their processes, which causes unnecessary delays.

As a result, I often have to follow up with them to ensure they are working efficiently and effectively on behalf of my clients. Over the years, this has required me to adjust my contracts and agreements to better align with realistic timelines and client expectations.

Appreciate you sharing that. What should we know about Breeze Credit Repair?

Breeze Credit Repair didn’t start as a brand it started with me helping people fix their credit. A close friend recognized the bigger vision and helped turn that service into a business.

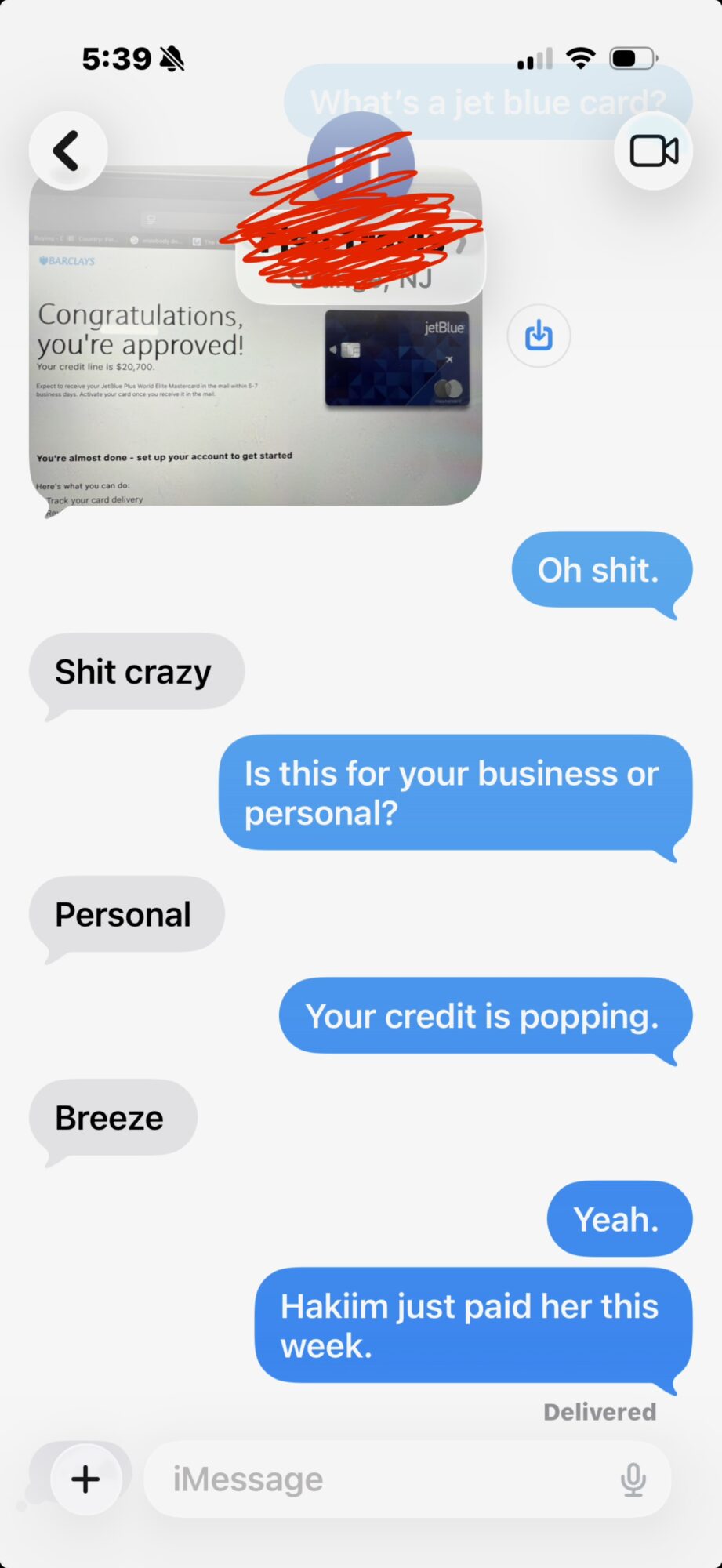

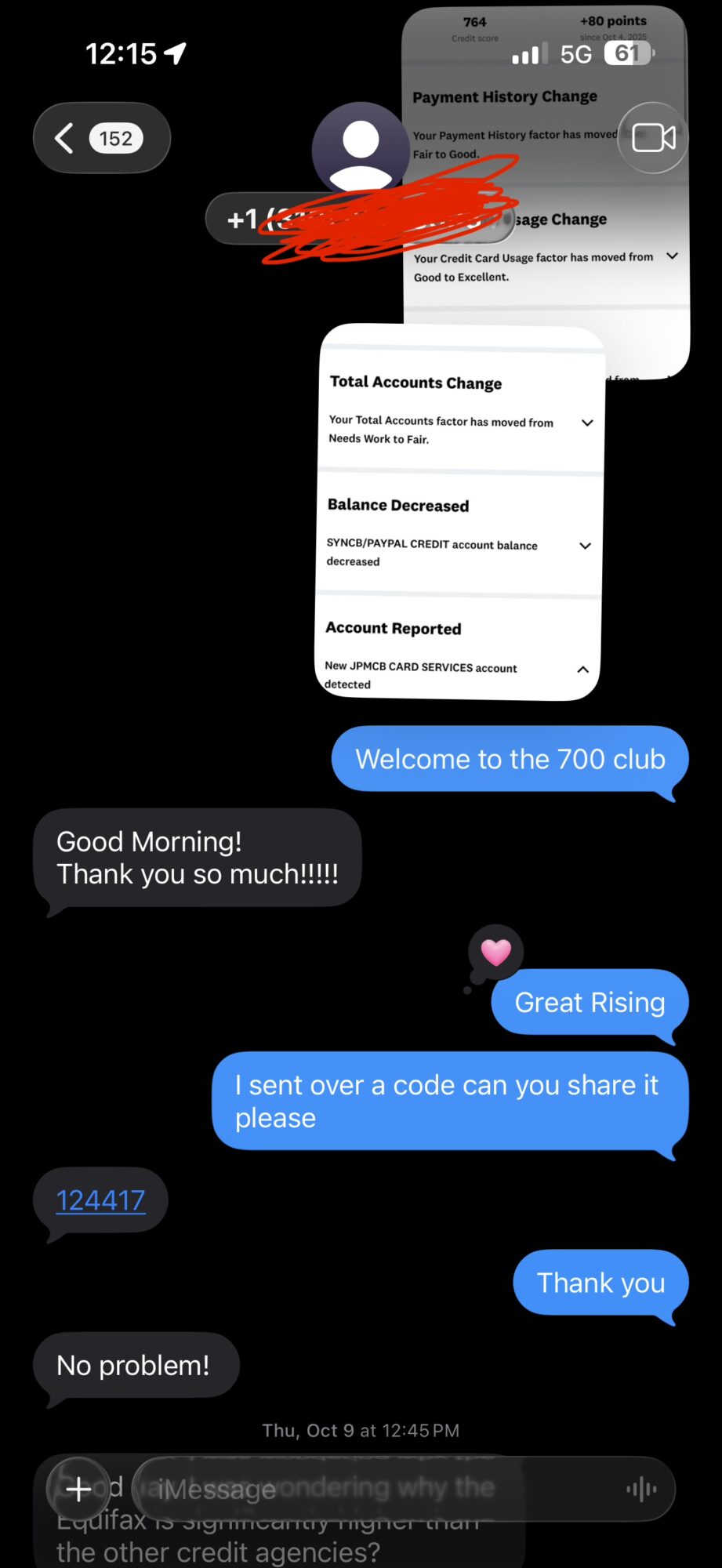

I specialize in personal and business credit repair and rebuilding. What sets me apart is my attention to detail, consistency, and hands-on approach. Unlike many companies, I work directly with my clients to understand their goals beyond the credit report, helping ensure they don’t end up back where they started.

What I’m most proud of is our integrity. We’re transparent, realistic, and results-driven. With us, credit repair isn’t just about fixing numbers it’s about building a foundation to grow and succeed.

In terms of your work and the industry, what are some of the changes you are expecting to see over the next five to ten years?

Over the next 5–10 years, I see the credit repair industry shifting toward education, transparency, and long-term financial empowerment. Beyond fixing credit, the future is about teaching people especially youth how credit works and how to use it responsibly to build wealth.

My goal is to evolve into an educational firm as well, creating programs like BCR University to teach financial literacy, credit mastery, and how to start and scale businesses in this industry. I believe the biggest shift will be moving from transactional services to education-based models that create generational impact and sustainable success.

Contact Info:

- Website: https://Breezecreditrepair.com

- Instagram: https://Instagram.com/breezecreditrepair

- Facebook: https://Facebook.com/breezecreditrepair

- Youtube: https://Youtube.com/breezecreditrepair