Today we’d like to introduce you to Setu Shah

Today we’d like to introduce you to Setu Shah

Hi Setu, thanks for joining us today. We’d love for you to start by introducing yourself.

My founder story is a mix of professional and personal experiences (plus a decent amount of luck) that led me to build this incredible company.

From a professional perspective, I’m lucky to have had numerous experiences that gave me exposure to healthcare and finance – two industries that intersect at the core of Financial Doula’s mission. Personal finance was instilled in me at an early age by my accountant, immigrant father who taught me the value of every dollar, and my learnings in finance and healthcare deepened throughout the years as a healthcare consultant for both large and small consulting firms. In addition, I received a Master’s in Business Administration (MBA) degree from Emory University Goizueta Business School which rounded my education in finance, business, and entrepreneurship. I am lucky to have had these incredible career and educational opportunities; however, none of that would’ve been possible without the hard work and financial challenges my parents overcame as immigrants to America and the values they passed on to me.

From a personal standpoint, I was blessed with a sweet baby boy in the Fall of 2022 and, yet, immediately felt the financial consequences of motherhood due to unpaid leave, lack of coverage for mental care, and job loss. Though it was immensely difficult to overcome these systemic hurdles as a new mom, I was again lucky to be in a position to learn from this situation and receive the support of a loving partner (who also has a passion for personal finance) help me find my way to building Financial Doula. I’m grateful for every challenge, learning, and opportunity and excited for the impact Financial Doula will have on the world!

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

The road is almost always a bit rocky but I try to remember that I’m lucky to be on the road! I shared a few snippets of my personal challenges in my founder story but truly the hardest part of the journey so far has been shifting my mindset. Our culture is one where women are praised to keep their head down, work hard, and not make any noise. Breaking through those barriers, loving myself for who I am, and trusting that what I’m doing is right for myself, my family, and the world has been a continuously evolving journey but one that is making me resilient and excited for what is to come.

From a market validation standpoint, Financial Doula is a unique concept that lingers between being a small industry business and an innovative startup. The concept of personal finance has been around for quite some time but “niche-ing” that down and hyper-focusing on first-time, expecting parents is new. Encouraging expecting parents to see beyond the status quo and realize the benefits of working with a financial expert during their journey into parenthood has been challenging. I’m learning that the success will come from their trust in me as an expert partner and in strategic messaging that resonates with the financial challenges they face as expecting parents.

Alright, so let’s switch gears a bit and talk business. What should we know?

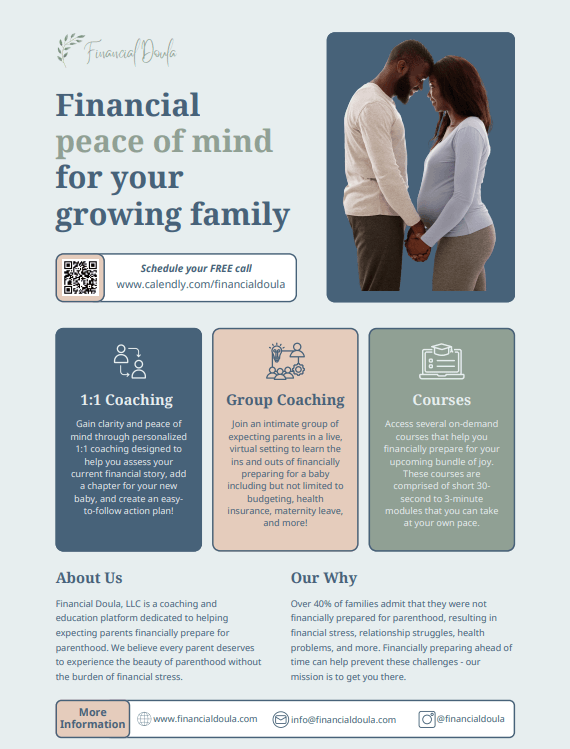

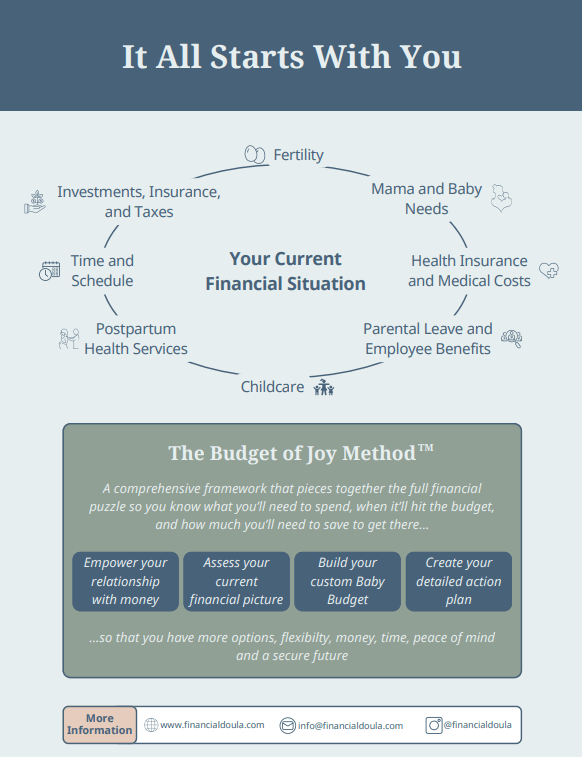

My name is Setu (pronounced “Se-thu”), and I am the Founder & CEO of Financial Doula – a consulting service dedicated to helping expecting parents financially prepare for the amazing journey into parenthood. I help expecting parents through 1:1 consultations, group coaching, in-person and virtual workshops, and online courses. My support begins with helping couples understand their relationship with money and how they manage their finances as one household unit. Once that foundation is built, I guide clients on how to build their custom Baby Budget based on their unique circumstances and help create an easy-to-follow action plan that allows parents to prepare quickly and reach their financial goals. Areas considered in the Baby Budget include fertility (optional), mom and baby expenses, health insurance/medical bills, parental leave, postpartum services, childcare, taxes, insurance, investments, time management, and more.

Most first-time, expecting parents today are left to their own devices to prepare for their first child. That often means they are turning to various friends and family members who may give them conflicting information, searching Google or social media platforms and getting overwhelmed with information, consulting their employers but getting the short end of the stick, getting confused by childcare options and what’s right for their family, and forgoing necessary investments and insurance that will protect their family.

Working with me will help you solve these challenges. You’ll have one place to manage everything you need to buy and prepare in your first year of parenthood, save time and money, create options and flexibility, and secure your family’s financial future. I believe all parents deserve to enjoy the beauty of parenthood without the burden of financial stress, and I’m on a mission to get every family there.

A little bit about me – I have over 15 years of finance, healthcare, and consulting experience and have an MBA from Emory University Goizueta Business School. I have lived and breathed numbers and spreadsheets for most of my life but my most important job is being a mother to my sweet, two-year-old boy. I strive to be a positive role model to him every day.

Financial Doula has been featured in Babylist as well as BestLife magazine and built hundreds of connections in maternity, parenting, and expecting mom communities. I am excited to continue to build momentum and make an impact on growing families. Reach out anytime at info@financialdoula.com – I can wait to meet you!

Is there a quality that you most attribute to your success?

My steadfast passion for the mission and relentless focus to help other expecting parents. Building a business from scratch is not for the faint of heart. There is noise, ups and downs, rejections, judgment, doubt, guilt…and the list goes on. I know in my heart that the mission of Financial Doula is much more important than all of that…and that’s what will keep me going!

Pricing:

- 1:1 Coaching – $3,000 – $6,000

- Group Coaching – $1,800

- Workshops – $750 – $2,000

- Online Courses – $25 – $150

Contact Info:

- Website: https://www.financialdoula.com/

- Instagram: https://www.instagram.com/financialdoula/

- Facebook: https://www.facebook.com/yourfinancialdoula/

- Youtube: https://www.youtube.com/@FinancialDoula

Image Credits

River West Photography