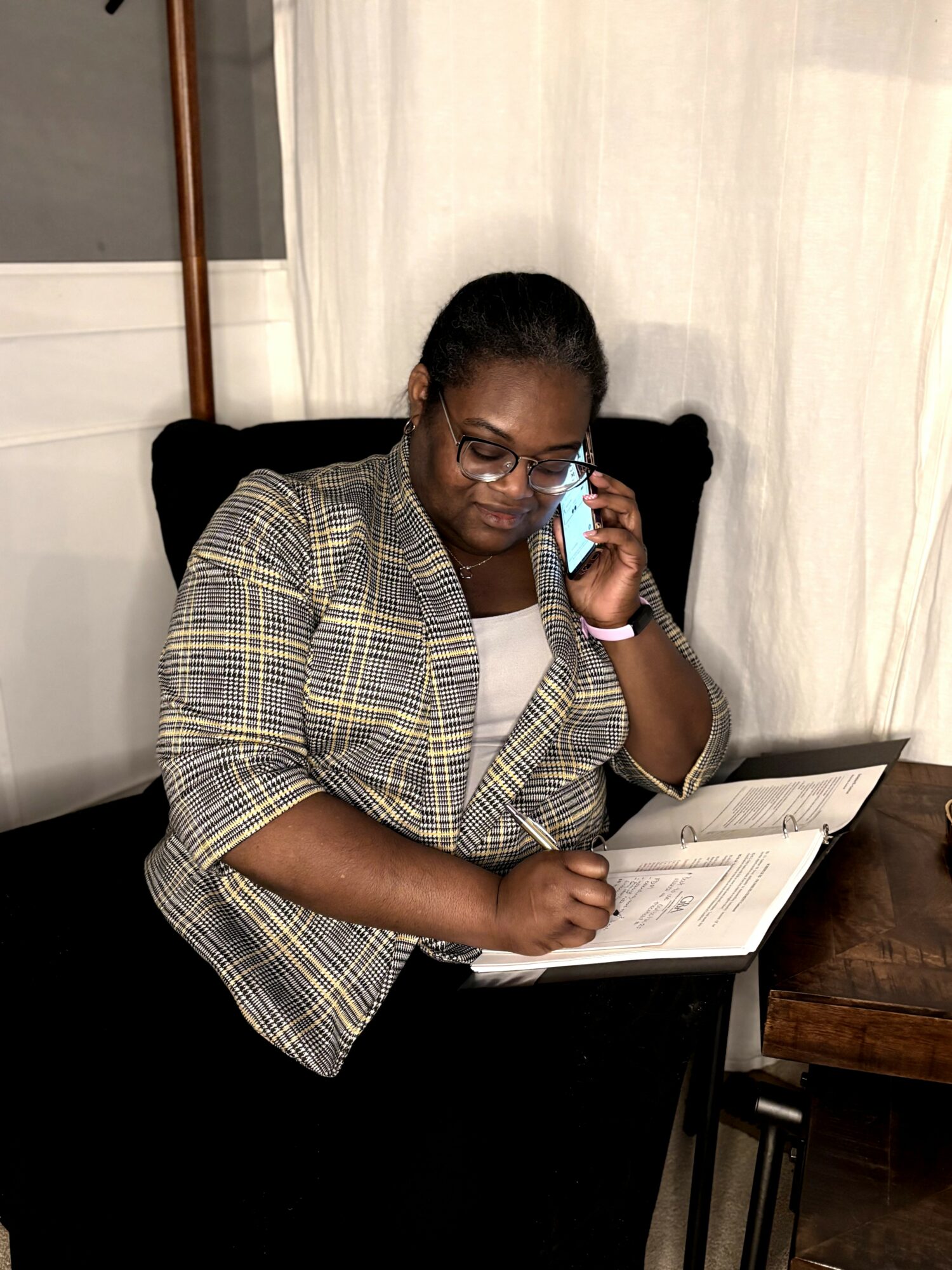

Today we’d like to introduce you to Lela Randle-Wells.

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

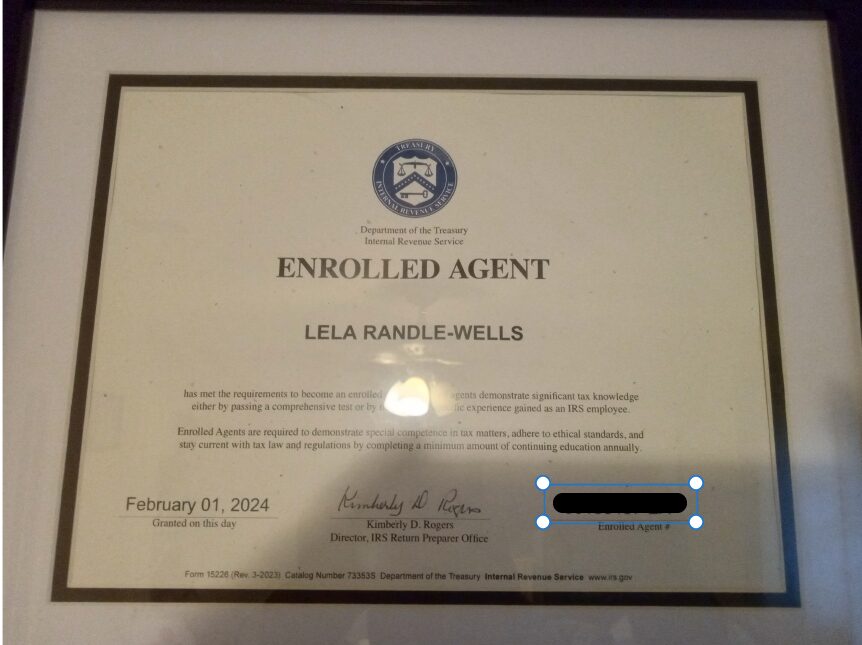

My journey to being an Accountant started after I saw the movie “Look Who’s Talking”. I was intrigued by the family talking about taxes and the calculator with a tape roll. I wanted to be an Accountant since the age of seven. I was so happy to get my first full-time job as an accountant in 2011 when I moved to Georgia. In 2019, I started All’s Well Tax Relief Services with the heavy encouragement from a friend and co-worker at the time. I was looking to find something that would give me time flexibility to start a family, and hated working my part-time job at a tax chain. I started off providing monthly bookkeeping services and preparing taxes. I worked a full-time job while growing my business. When COVID hit, I went to provide remote services. I have spent years growing and learning the tax business to provide better service to my clients. I went on to become an Enrolled Agent (EA) certified by the Internal Revenue Service, so I could represent more people with the IRS.

I now help individuals and business owners resolve debt with the IRS and Georgia that is $15,000 or more. I love being able to really help people when things seem impossible.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

It definitely has not been smooth. Since I am a solopreneur still working a full-time job, I have struggled with finding staffing and proper systems. I have experienced growth and decline. I have gone through the feeling of wanting to quit, but I truly do love taxes and helping others. Every year I just continue to try and make something better in the company. This year, I am focusing on the onboarding processing for the tax preparation and tax resolution clients.

Alright, so let’s switch gears a bit and talk business. What should we know about your work?

I enjoy working with individuals that are also growing a business. My heart really goes out for those that are still working another job while doing it. I enjoy tax planning with them, so they can see tax strategies they can take advantage of to save what they pay at tax time.

I am really proud when a taxpayer learns something they did not realize they could do to lower their tax liability. Just recently I helped a couple of W2 earners understand how they should be completing their W4 for a better tax outcome. I believe what sets me apart from your typical tax firm is my ability and desire to make my service attainable to those that really need it. I allow those that need it to set up payment plans. I also think that I still try and keep reasonable prices for the value of my services that work for the business and the potential client.

Networking and finding a mentor can have such a positive impact on one’s life and career. Any advice?

I will say do not do like me and pay for all the mentors that are in the field but focus on different things you are not ready to pursue. I believe strongly in taking advantage of free avenues to find mentors and then watching them before signing up for a program. I started off in many professional groups and three different mentors. I have dropped to two paid professional memberships and one paid mentor. I take advantage of a free networking groups and try to attend three to four events in the year. My calendar stays full, but I learned if I do not block it on my business calendar; it will not happen.

Contact Info:

- Website: https://www.allswelltaxservices.com

- Instagram: https://www.instagram.com/allswelltaxservices

Image Credits

M.D Mitchell