Today we’d like to introduce you to Olivia Ehiwe.

Hi Olivia, please kick things off for us with an introduction to yourself and your story.

Your Budget Consultant started in a place of desperation. I just graduated from college at Georgia Gwinnett College with a Business degree and Accounting Concentration. I started my first job as an accountant with a Law Firm in downtown and was making good money. After a few months of working student loans came knocking on my door. I found it difficult to pay “sallie mae”, live as an independent young professional, and build up my future. This is where I started my journey to Financial Freedom. I bought books, study financial planning, followed so many financial gurus and was still unable to properly manage my money. After having life knock me down a little, I sought the help of the Bible that gave me wisdom and decided to turn off the gurus and start from the very beginning. After much success, this birthed a desire to help friends and family. I then learned that my generation has been handed a major crisis that was passed down to us. The lack of financial education in our homes and schools has handicapped my generation from independence and building financial wealth. Now I teach my generation how to budget from the very beginning. The beginning steps of financial independence and freedom.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

No, it has not been a smooth road! My formula that I use in my Masterclass is one that has been birth through experience. When my mother passed in 2016, a few months after graduating college, life became real. I could no longer afford to waste my life by play safe so I started to take risks. Some of the risks landed me back at home in my parent’s house however, some risks allowed me to pay off 15k of debt. It is in every risk that I have taken in my young life that I can now say I am building with my money and not just existing by working only to pay bills every month.

Thanks – so what else should our readers know about Your Budget Consultant?

I am a Budget Consultant. I have a Bachelors in Accounting from GGC and seven years of experience as an accountant. I have worked for international multi-million companies and have seen them grow year by year all through one major initiative, A BUDGET! If a multi-million dollar company operates off of a budget and stays in the status of a “multi-million” then why do we not live our lives the same why. The rich do! I tear down the ideology that budgeting is just restriction mechanism that controls your finances and replaces it with the one that budgeting gives you freedom in the process of building.

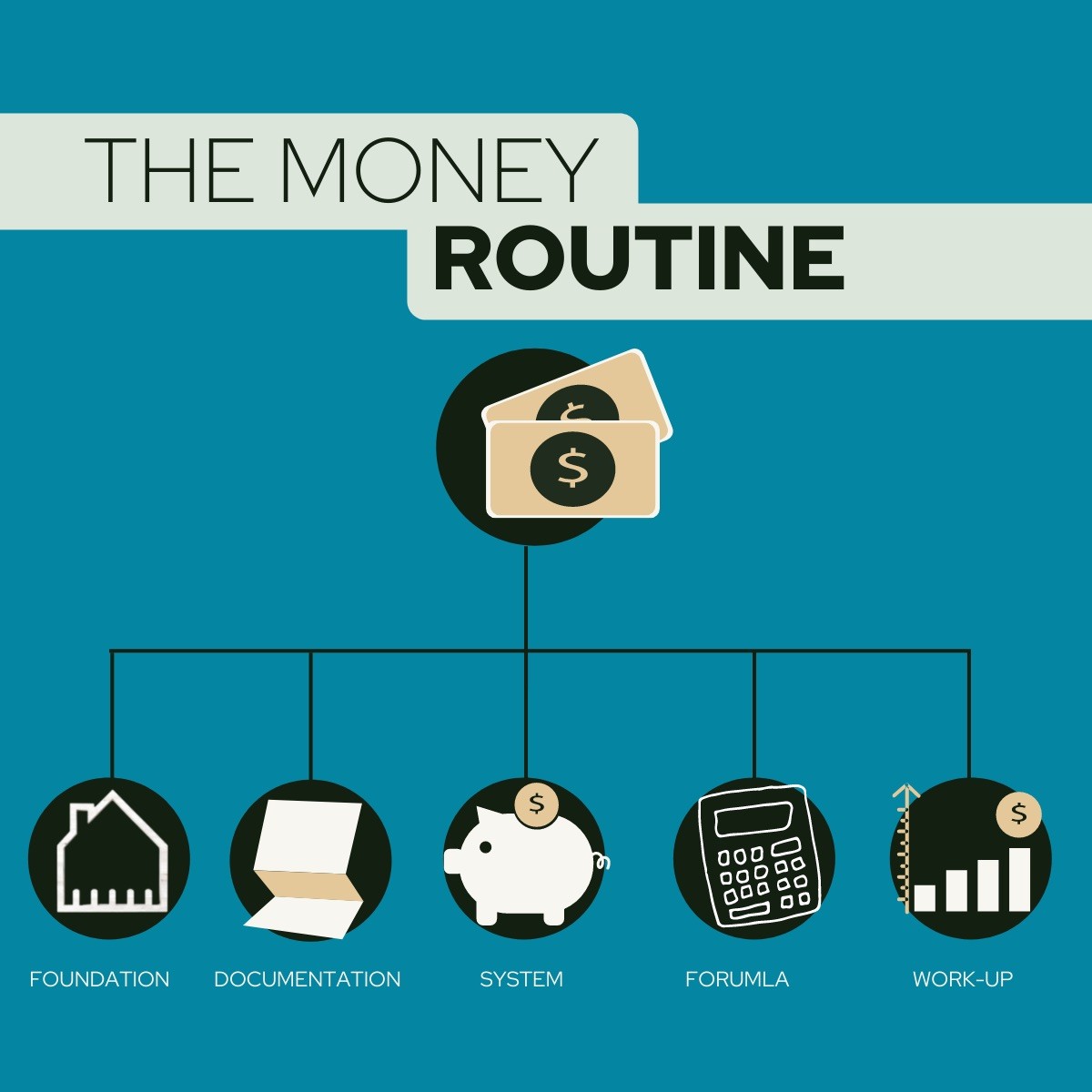

To a generation that was thrown into adult life with little or no financial preparation, I started Your Budget Consultant as a means to help those in this the financial GAP. I focus on Budgeting 101. I offer a masterclass that provides people with a formula to learn how to budget successfully and reveal their bad spending habits. I offer services to help individuals come up with a personalized plan that fits the lifestyle they want to live. These services also prepare them for major financial decisions as in budgeting to buy a house, budgeting to attack major debt, etc.

One thing I always share with my clients is that there is no one perfect way to budget. However, there are methods that make combinations. When these combinations are placed together, it births out the perfect budgeting method for you and the vision for your life.

We’d love to hear about how you think about risk taking?

Taking risk is apart of living. The moment you realize you have not taken any is the moment you have allowed life to pass you by. Risks can be having a child, getting married, moving to a new city, leaving jobs that make you comfortable for one that will challenge you, taking a year off of working or deciding to sacrifice a way of living for a better way in the latter years. Risks are labor pains to a pregnant woman. It is something you must go through in order to see what could be birthed through you.

Yes, my last risk was deciding to leave a nice comfortable job where I had a skyscraper window office making good money to only work 10 hours and watch movies the other 27.5 hours for entrepreneurship. I took months off of work with no job in sight, moved back home again to minimize costs, and built my business from the ground. I will let you know in three years what that the right move or not. So far, it has been going great though!

Risks is living past what makes you comfortable to expose what is actually in you!

Contact Info:

- Email: admin@oliviaehiwe.com

- Instagram: www.instagram.com/yourbudgetconsultant/

- Other: linktr.ee/yourbudgetconsultant